Helping With Your Tax Issue

Losing sleep over IRS problems? Click one of the boxes below to get started.

We’re on Your Side – Top Miami Tax Attorney

Thank you for visiting our web site. My name is Steven Klitzner and I’m a Miami tax attorney whose practice focuses exclusively on solving IRS problems and tax debt issues throughout Florida.

Resolving Your IRS Problems

By now you probably have realized that the IRS can be very intimidating and aggressive to the tax payer. However, we can eliminate that stress for you. I will deal directly with the IRS on your behalf. You no longer have to deal with the harassing phone calls and letters from the IRS. Your tax problems can be solved for good.

Experience dealing with the IRS

As an experienced IRS tax attorney, my associates and I deal with the IRS on a regular basis, and we have the knowledge and experience to advise you of options for resolving your tax problems. The IRS officers’ actions and advice are in the governments’ best interest.

You deserve someone working on your behalf to protect your interests. IRS problems do not go away unless they are dealt with. In fact, they only get worse the longer you wait to have them taken care of, with penalties and interest being added daily. As a lawyer who has dealt with the IRS for over 40 years, I will work to get you the best possible outcome available.

Don’t delay, get started today.

As you may already know, the IRS can garnish your wages, put liens and levies on your bank accounts and homes, and much more.

Don’t wait any longer to have this taken care of and get the peace of mind you have been wanting. By contacting an IRS tax debt attorney such as myself, you can reduce your tax debt, potentially remove a lien, stop a garnishment and put an end to your sleepless nights.

Please click on our “Solutions” page to learn some of the many services we offer, or the “Problems” page which highlights different IRS issues we commonly address for our clients.

Florida Residents – We’re Local!

If you’re looking for a Florida tax attorney you’ve found us! We’re happy to meet with you in-person to discuss your tax problems.

Law Office of Steven N. Klitzner, P.A.

2627 N.E. Ives Dairy Road, Suite 213

Miami, FL 33180

Are you ready for a consultation?

Our firm will take the time to listen to your needs and determine the best course of outcome. > Request a Consultation

Miami Area and Communities Served

Our Service Areas:

From Our Blog

Get the latest news on IRS tax laws and how it affects your family and business here.

-

Does The IRS Pay Interest on ERTC Credits?

If you’re a business owner who applied for the Employee Retention Tax Credit (ERTC or sometimes ETC or ERC), there’s good news on the horizon! After a long pause to…

-

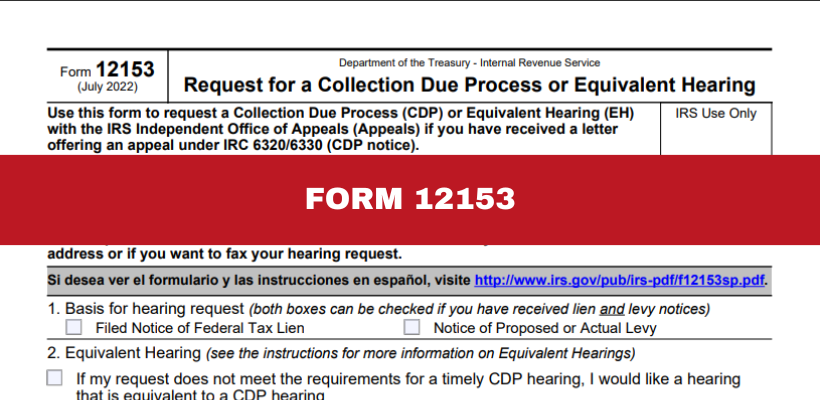

IRS Form 12153: How to Request a Hearing and Stop IRS Collection Actions

When the IRS initiates collection actions like liens or levies, it can be a stressful experience. However, taxpayers have rights and options to challenge these actions. One powerful tool at…

-

How to Apply for the Second ERC Voluntary Disclosure Program?

With the announcement of the second Employee Retention Credit (ERC) Voluntary Disclosure Program (ERC-VDP) for 2021 tax periods, businesses, tax-exempt organizations, and government entities now have an opportunity to correct…

Contact Us For Your FREE Personalized Tax Debt Analysis

To schedule a consultation with our firm, call (305) 564-9199, toll free at (800) 219-1118, or complete the contact form below.