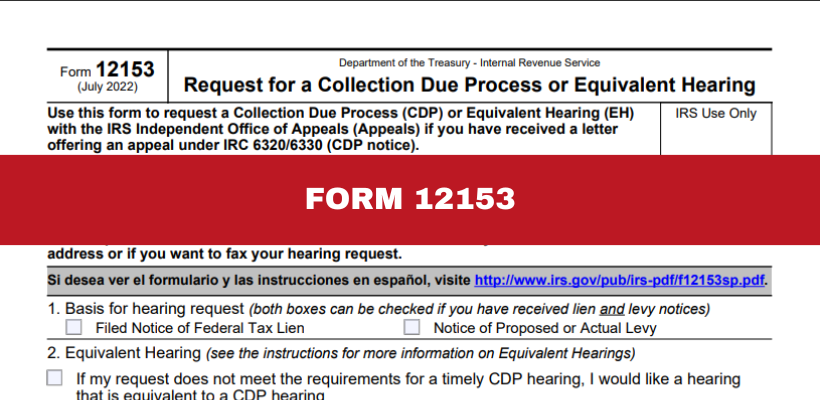

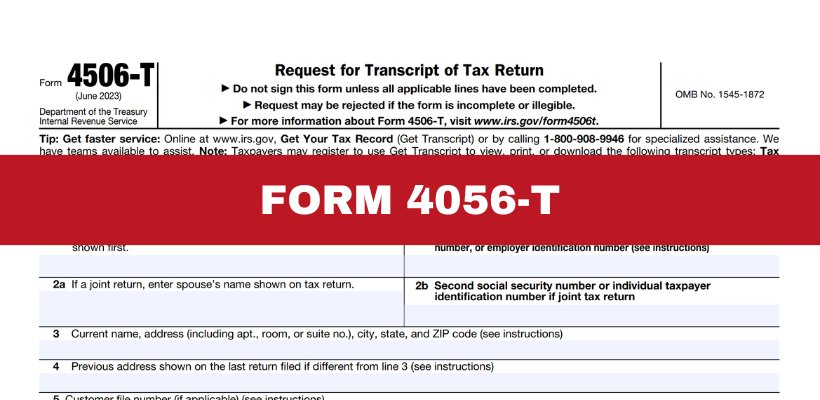

When I obtain transcripts from the IRS for my clients I always look for the day the tax was assessed because the IRS only has 10 years to collect the debt. However, there are some events that can occur over that period of time that stops the Statute of Limitations temporarily. They include offers in compromise, collection due process hearings, requests for installment agreements, and bankruptcies.

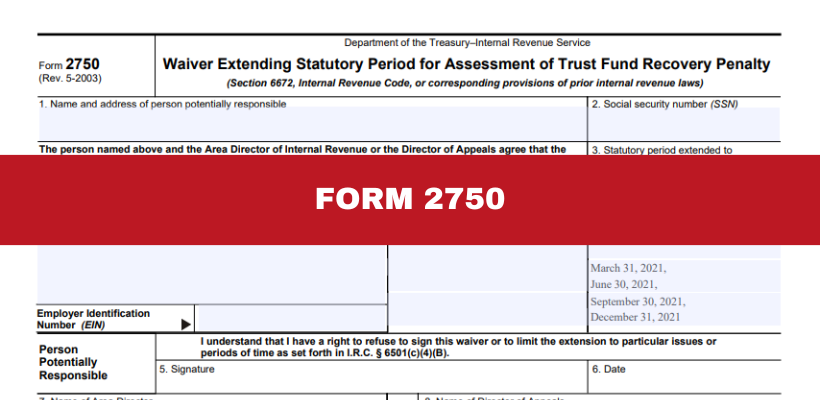

IRS Form 2750: Extend Your TFRP Assessment Period and What It Means for You

When it comes to payroll taxes, the IRS takes noncompliance very seriously. Employers are required to withhold certain taxes—known as “trust fund taxes“—from their employees’ wages and remit them to … Read more