Earlier this year I was asked by the American Society of Tax Problem Solvers to teach two day IRS Tax Resolution Boot Camps around the country. The attendees are attorneys, CPAs and enrolled agents. Some of them have experience in this field, but the majority have never handled an IRS Collections case.

Why Taxpayers Should Never Talk to the IRS!!

“Before I get help for my IRS problem, I’m going to go speak personally to the IRS officer or agent. Once they hear what I have to say, I am sure they will understand.” Some people who receive a notice from the IRS think that this is a great strategy because after all, what could go wrong? The answer is EVERYTHING.

Tax Planning Tips for Small Businesses

Tax planning is a critical aspect of running a successful small business. It involves making strategic decisions and taking proactive measures to optimize your tax liability, maximize deductions, and ensure … Read more

Tax Identity Theft: What You Need To Know

Tax-related identity theft has impacted more than 1 million federal taxpayers to date, according to a recent USA Today article. While the same article writes that incidents of identity theft related to fraudulent tax returns has decreased in the past year, IRS Commissioner John Koskinen recently testified that the nature of tax identity theft has shifted: Once committed by individuals, he says tax identity theft now involves sophisticated crime syndicates who hack internal online systems to gain personal taxpayer information.

Summary of 2012 in Taxes

2012 has proven to be a tumultuous year when it comes to taxes. While there have been many changes during 2012, most were overshadowed by the flurry of changes prompted … Read more

Solving Tax Problems – Offer In Compromise

If you are struggling with a tax debt that you cannot realistically repay, an offer in compromise may provide a workable solution, and a tax attorney can help you file … Read more

Should You Ignore an IRS Notice if You Believe it’s a Mistake?

If you’ve received an IRS notice and believe it’s a mistake, you might be tempted to ignore it, especially if you’re confident the issue will resolve itself. However, ignoring the … Read more

Settling Your IRS Tax Debt

Learning that you have tax debt can be unwelcome financial news, especially if you didn’t account for additional tax payments in your budget.

Though you’re legally obligated to settle back taxes that are legitimately owed, there are cost-effective payment methods you can use to settle IRS tax debt. Here are some of the most popular payment options to consider for tax debt relief, and the pros and cons of each.

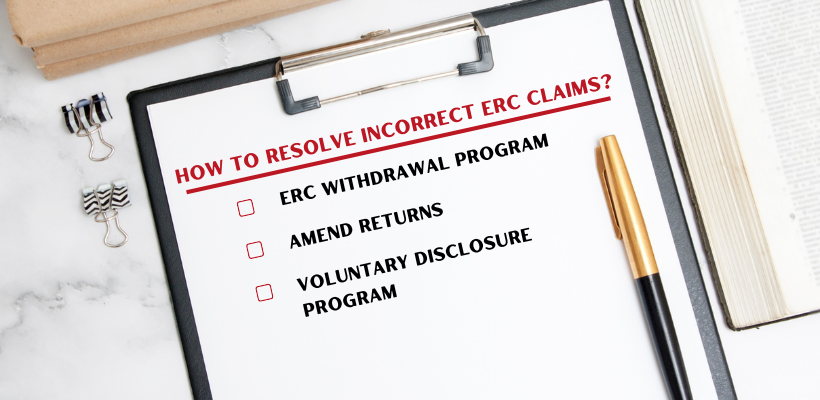

ERC Claims Error? Here’s What The IRS Wants You to Do

If you suspect inaccuracies in your ERC claim, the IRS has outlined several options to help you correct the issue and avoid potential penalties and audits. Here’s a detailed guide … Read more

Quarterly Estimated Taxes Deadlines

I’m tax attorney Steve Klitzner. My practice is limited solely to representing individuals and businesses with IRS problems. One misconception that people have is that the April 15th deadline is … Read more

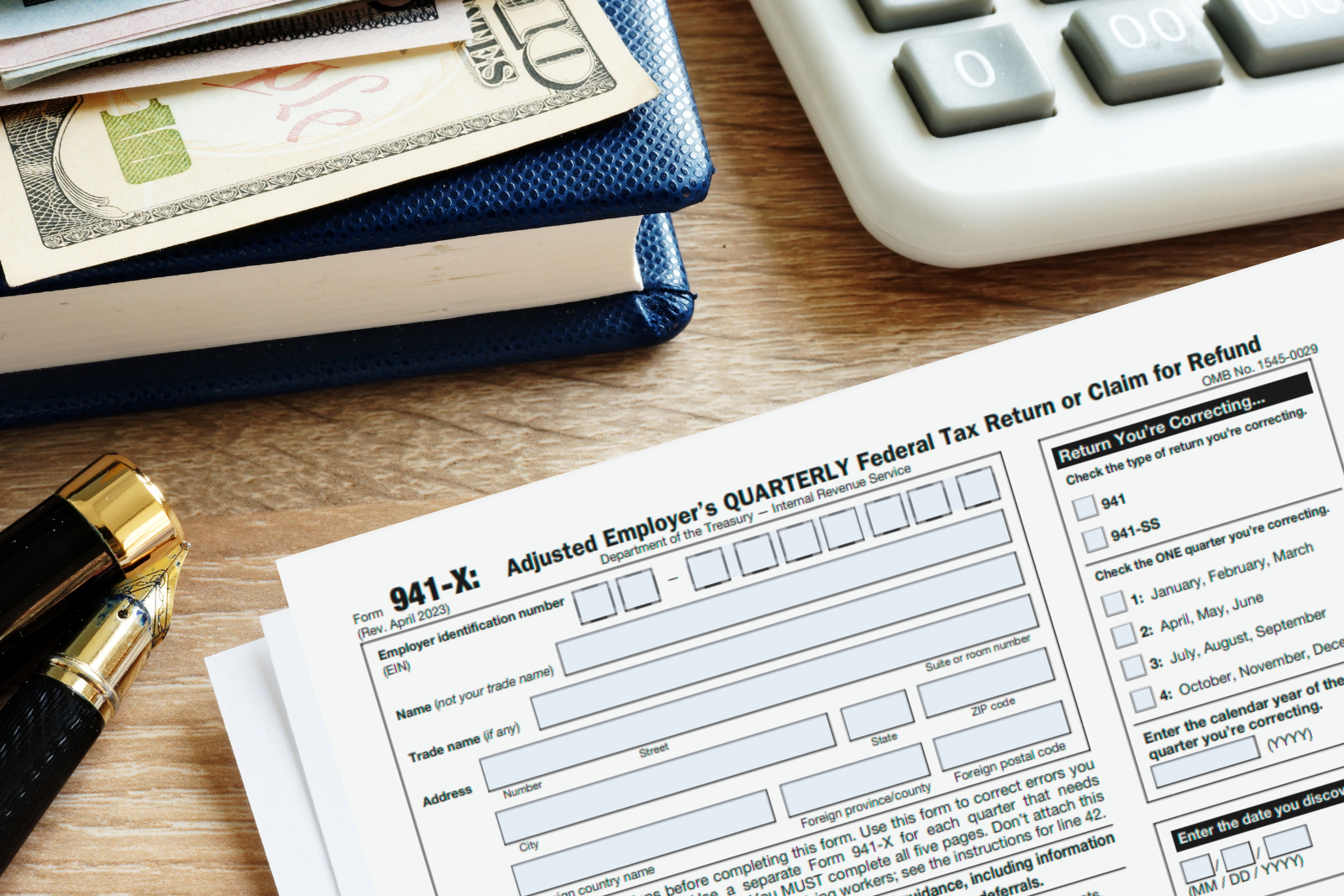

What is the Process for Submitting an ERTC Tax Credit Claim?

When exploring the process of claiming the Employee Retention Credit (ERC), also known as the Employee Retention Tax Credit (ERTC), it’s essential to understand that it revolves around the revision … Read more

Power of Attorney: Who Can Represent You Before the IRS?

When dealing with tax matters, it can often be beneficial to have a qualified representative act on your behalf. The IRS allows several types of professionals and individuals to serve … Read more

Power of Attorney

I am tax attorney Steve Klitzner. I developed my practice solely to representing individuals and businesses with IRS problems. Now the Law says that if I have the Power of … Read more

Paying Unfiled Tax Returns – IRS Tax Problems

I’m tax attorney Steve Klitzner. My practice is limited solely to representing individuals and businesses with IRS problems. I estimate about 85% of the people that see me for the … Read more

Owe the IRS Money and Can’t Make Payments?

One of my favorite tax problem solutions is to have the IRS declare my client Currently Not Collectible (CNC). This is for citizens who cannot make even the smallest payments on their outstanding debts. Maybe they are out of work, short or long term, or maybe they just do not make enough income to pay all of their expenses. If this is the case, CNC status is often the answer.

Most Common Tax Penalties & How To Avoid Them

Filing your taxes correctly and on time is one of the most important things you can do every year to protect your financial situation. This is because, on top of … Read more

Most Common Question

Hi. I’m tax attorney Steve Klitzner. My practice is limited solely to representing individuals and businesses with IRS problems. Here’s a common question that people ask. Probably the most asked … Read more

Most Common Payroll Tax Problems and How to Avoid Them

It’s no secret that filing your taxes can be complicated and daunting, but anyone who has ever filed taxes for a business knows that there is even more room for … Read more

Miami Tax Attorney Steve Klitzner Explains Offer in Compromise (OIC)

I’m tax attorney Steve Klitzner. I represent individuals and businesses that have IRS problems. One of my favorite questions I hear from friends, family, clients, prospective clients is, “We see … Read more

Should you hire a Local Tax Attorney or a National Company?

When it comes to resolving an IRS problem, many taxpayers consider hiring a nationalcompany to represent them. While it may seem like a convenient and efficient option,using a local attorney … Read more