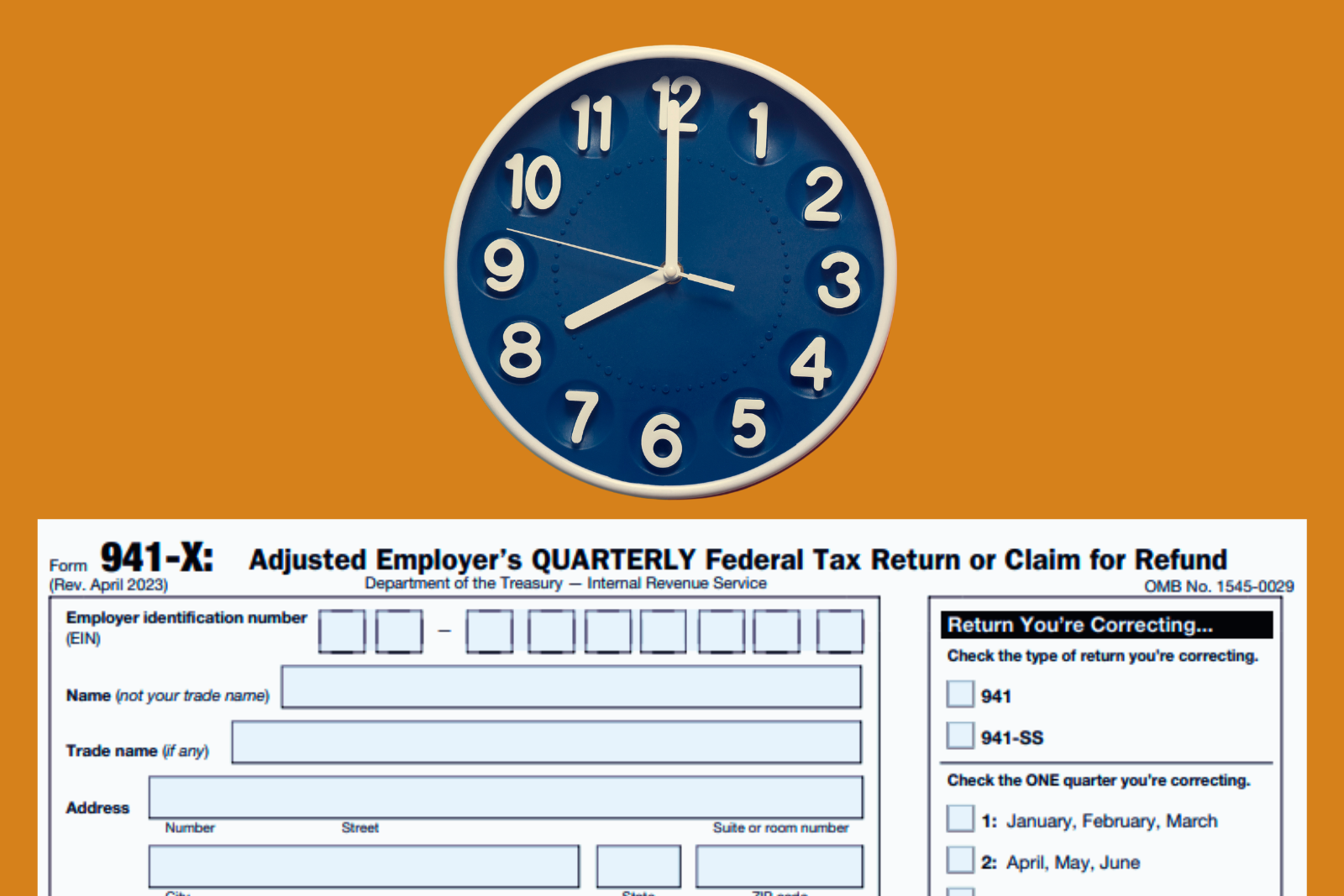

Many small businesses are unable to pay their payroll taxes for various reasons. Often, they do not have enough money to pay all of their bills. If they do not pay their rent, they will get evicted. If they do not pay their utilities, they will be shut off. If they do not pay their vendors or suppliers, they will not be able to do business. If they do not pay their employees, they will quit. The easiest creditor not to pay is the IRS because they do not have their hand out at the end of the week. Of course, the IRS believes they should be first in line, so if they do not get paid, they come back with a vengeance, levying bank accounts, credit card processors, and accounts receivables.

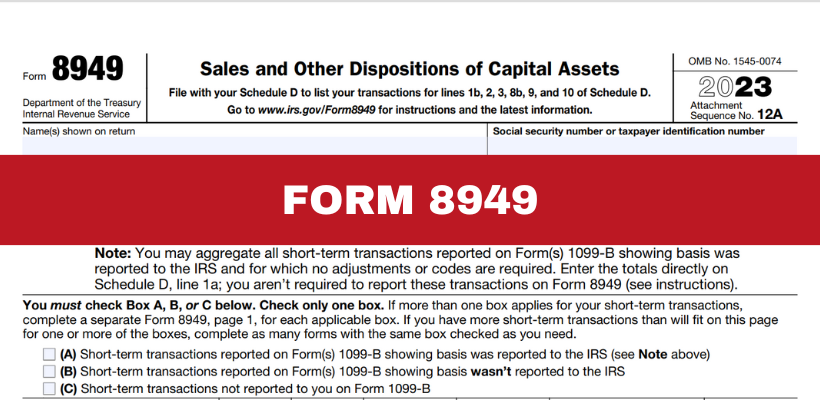

Filing Taxes on Investment Sales? Use IRS Form 8949 (Here’s How)

Tax season often brings a flurry of forms and documents, each serving a specific purpose in the complex landscape of tax filing. One such form, often a point of confusion … Read more