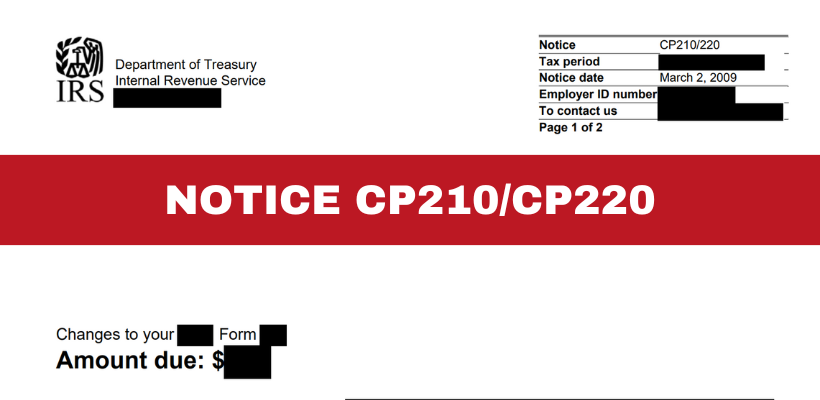

What You Need to Know About IRS Notice CP210/CP220

When the IRS identifies discrepancies or adjustments needed for a specific tax year, they notify taxpayers through Notice CP210 or CP220. These notices are typically sent to businesses, informing them … Read more

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...