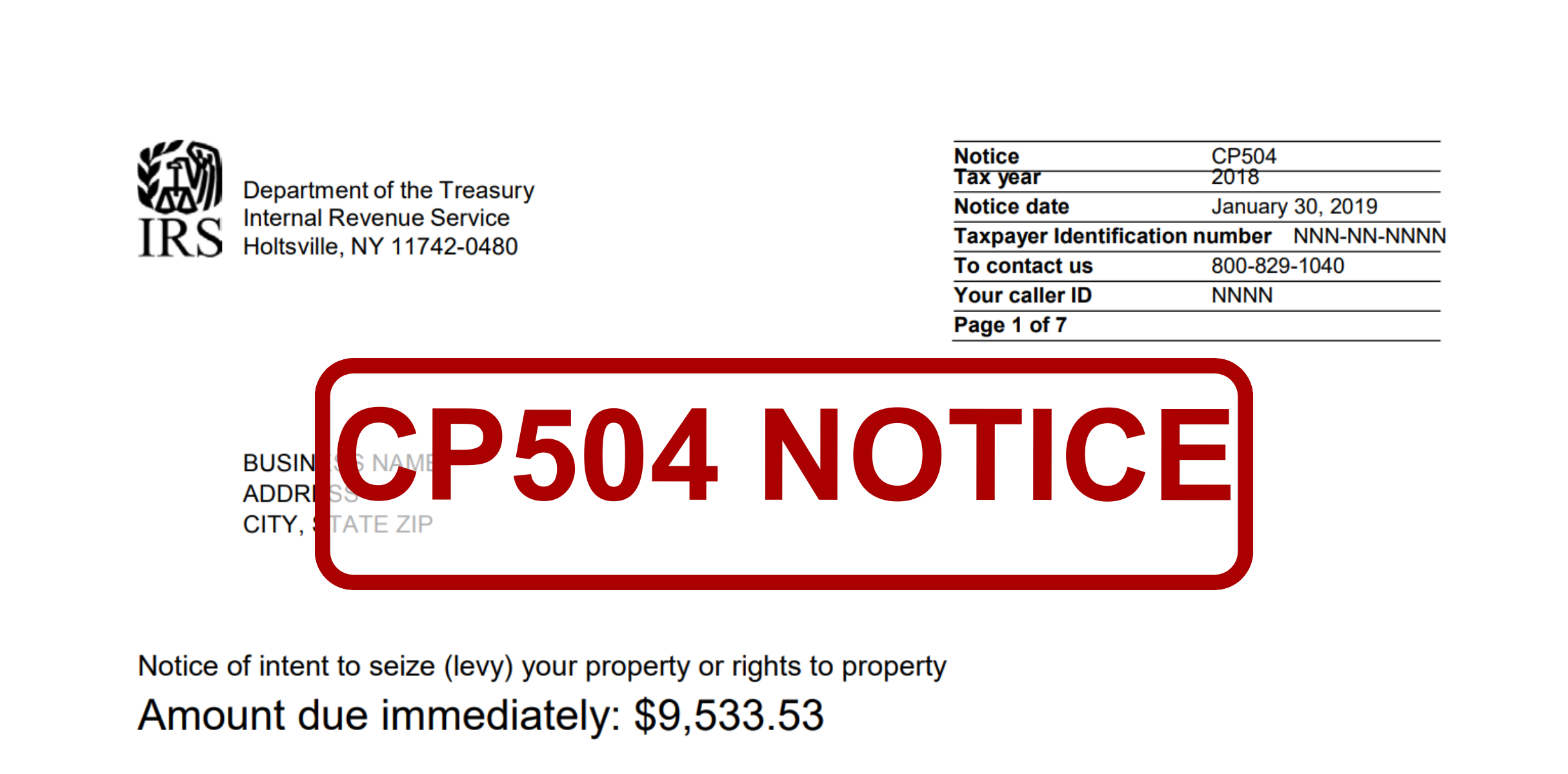

The CP504 Notice from the IRS is a critical document that taxpayers must not ignore. Unlike the other preceding correspondences about outstanding tax debts, the CP504 Notice requires prompt attention. In this post, we will examine the details of this notice and uncover the reasons behind the urgency it carries.

What is the IRS CP504 Notice?

The IRS CP504 Notice is a formal communication sent by the Internal Revenue Service to taxpayers about their unpaid taxes. It serves as a final warning before the IRS takes more aggressive collection actions explicitly stating the intent to levy property or income if no action or payment is made within 30 days from the date of notice. This notice is also known as a notice of intent to seize (levy) one’s property or rights to property.

What are the contents of the CP504 Notice?

The IRS CP504 Notice generally provides important details about the taxpayer’s outstanding tax debt and signals the IRS’s intention to undertake more assertive collection measures. Though the specifics may vary, a typical CP504 Notice includes the following common elements:

- Notice of Intent to Levy

The letter mentions that it serves as a Notice of Intent to Levy property or rights to property which include wages, real estate commissions and other income, bank accounts, personal assets such as car and home, and social security benefits.

- Amount Due

One of the most important components of this notice is a breakdown of the total amount due immediately. This includes the original amount owed plus penalties and interest charges.

- Payment Options

The notice provides information on various payment options available to the taxpayer. It outlines the steps to make an immediate payment, emphasizing the importance of settling the entire amount to prevent further collection actions.

- Right to request an appeal

Taxpayers receiving the CP504 Notice have the right to request an appeal under the Collection Appeals Program (CAP) before any collection actions take place. The notice includes information on how to initiate this process and what steps to follow.

- Information on Passport Certification

An essential element of the CP504 Notice is information regarding the denial or revocation of a U.S. passport under the Fixing America’s Surface Transportation (FAST) Act legislation. Taxpayers are informed about the potential passport certification consequences linked to seriously delinquent tax debt.

- Penalties and removal or reduction options

The notice provides clarity on any penalties associated with the unpaid tax debt. It also includes information about options for the removal or reduction of penalties if specific conditions are met. Understanding these options is crucial for taxpayers seeking resolution.

- Interest charges

Details about interest charges incurred on the outstanding balance are outlined in the notice. Taxpayers are made aware of the ongoing accrual of interest on the unpaid amount and the implications of not addressing it promptly.

Final Thoughts

The IRS CP504 Notice is one that demands immediate attention and decisive action from taxpayers. The importance of taking swift action cannot be overstated enough here. Ignoring or delaying engagement with the IRS may lead to severe consequences, including levies, passport-related issues, and accruing additional penalties.

Thus, by proactively understanding the notice, exploring available payment options, and utilizing appeal rights through the Collection Appeals Program (CAP), taxpayers can mitigate potential repercussions, and work towards a resolution to their outstanding tax debt.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...