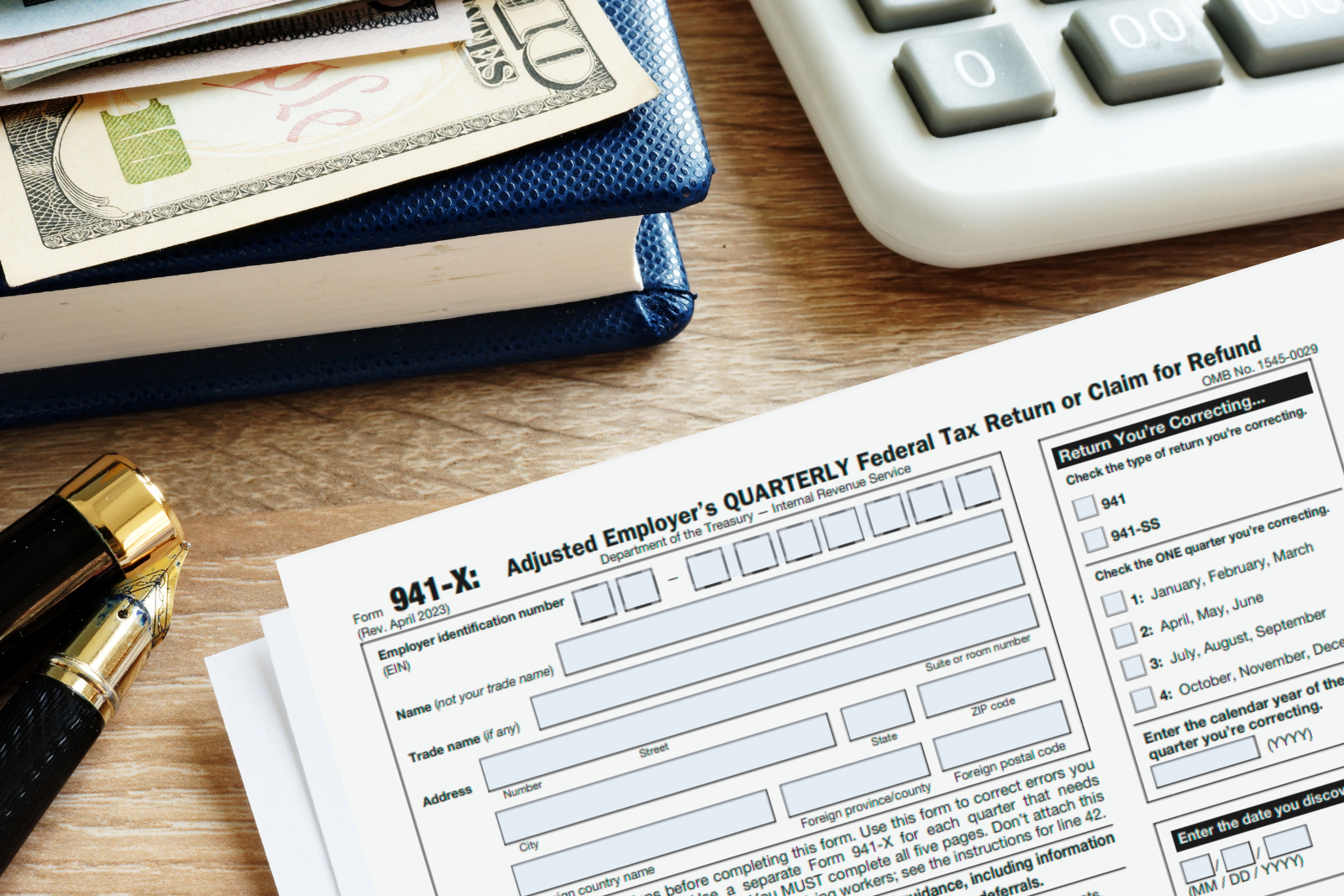

When exploring the process of claiming the Employee Retention Credit (ERC), also known as the Employee Retention Tax Credit (ERTC), it’s essential to understand that it revolves around the revision of previously filed Form 941s.

Here’s an explanation of the steps involved in submitting an ERC claim:

- Initial Submission: Begin by amending your Form 941s for the quarters during which you are claiming the ERC. This involves revising the previously filed returns to reflect your eligibility for the credit during the specific quarters of the COVID-19 era.

- IRS Review and Processing: Once submitted, the IRS will process your amended returns. Processing times can vary based on the IRS’s workload and staffing levels. If your amended 941s meet the requirements, the IRS will issue a notice of approval and inform you that a credit has been applied to your employer account.

- Credit Allocation and Refund: After approval, the IRS first applies the credit to any taxes you owe. If your account has no outstanding liabilities and a credit remains, the IRS typically issues a refund within 3 to 4 weeks. The refund check is sent to the address on file with the IRS.

Remember, the process can be complex, and it’s often advisable to seek assistance from a tax professional or accountant who specializes in ERC claims to ensure accuracy and compliance.

Furthermore, documentation supporting your eligibility, such as records of wages paid to employees during the eligible periods and evidence of business disruptions due to COVID-19, should be well-organized and readily available in case the IRS requests further information or verification.

Note that the IRS has been receiving many fraudulent ERC claims and as such they have put an intentional slowdown on the processing of ERTC claims as of September 2023. They have also announced increased focus on auditing ERTC claims. So its important to make sure your claim is compliant with the terms and stipulations of the program!

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...