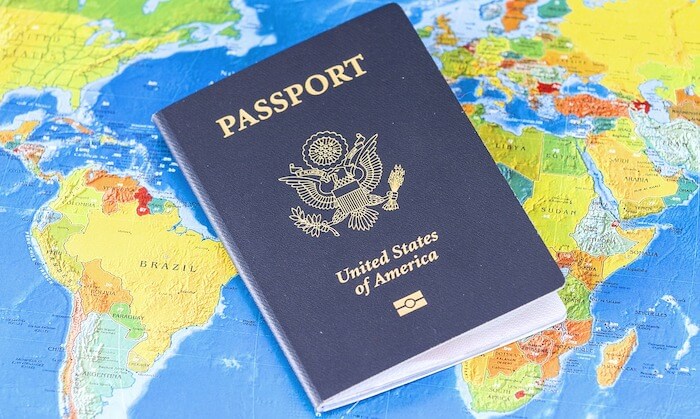

If you owe the IRS money, you may not be able to leave the country. The IRS is taking away passports as part of IRS Section 7345. It allows them to advise with the State Department to suspend or deny the passports of taxpayers. Luckily, this mostly applies to those who owe a lot of money.

Ignoring Your Tax Problems Is Costing You More Than You Think

Finding out you are being audited by the IRS or that you owe a tax debt can be intimidating. It is only natural to want to ignore the problem and … Read more