Facing the IRS CP14 Notice can be nerve-wracking, but with a bit of understanding, you can navigate through it successfully. While the prospect of unpaid taxes can be worrisome, understanding the common implications of the CP14 Notice is vital.

In this guide, we will explore the nuances of this notice, providing you with the insights to navigate the complexities effectively. Join us as we break down the intricacies of the IRS CP14 Notice and provide you with the knowledge needed for a resolution.

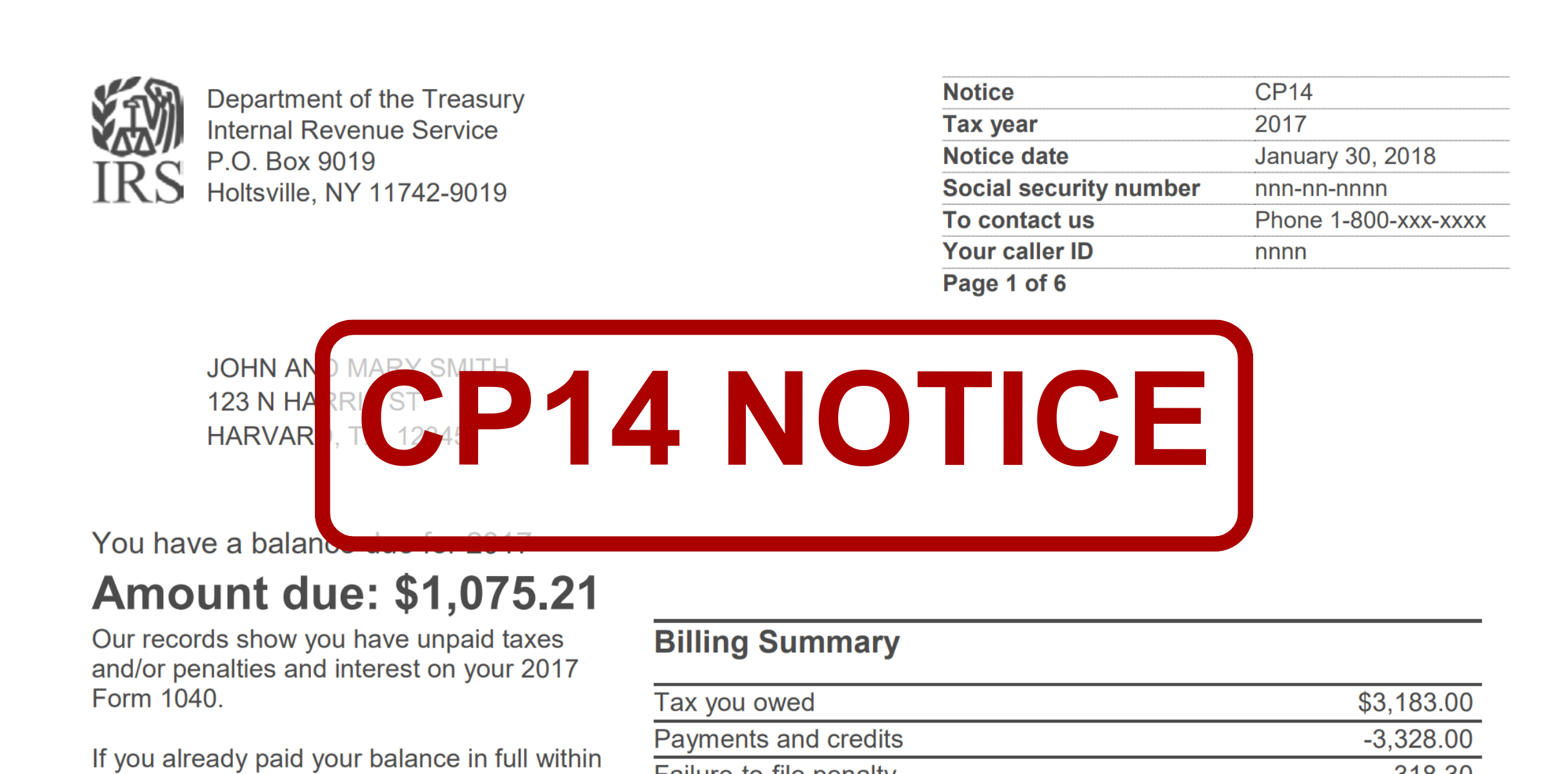

What is the CP14 Notice?

The IRS CP14 Notice is a communication from the Internal Revenue Service (IRS) sent to individuals who have unpaid taxes. This letter is essentially a notification to inform taxpayers about the outstanding balance they owe to the IRS. It typically includes important details such as the amount owed, the due date for payment, and instructions on how to address the issue.

The notice is not meant to be punitive but serves as a proactive way for the IRS to communicate with taxpayers about their tax obligations. It provides an opportunity for individuals to understand the nature of unpaid taxes and to take appropriate steps to resolve the matter, whether by making a full payment by the due date or by setting up a payment plan.

What should you do after receiving a CP14 Notice?

When you receive a CP14 Notice, it’s crucial to read it carefully and take prompt action. Ignoring or delaying the resolution of the outstanding tax balance may result in additional charges, such as interest and late payment penalties.

Here are the actionable steps you should consider:

- Read the Letter Carefully

Open and read the CP14 Notice as soon as possible and pay close attention to both the amount owed and the due date for payment.

- Access Your Online Account

If you possess an Online Account with the IRS, take the initiative to log in. This will enable you to view and download the notice conveniently.

Additionally, consider opting for a paperless approach for future letters or notices to enhance communication efficiency.

- Understand the Details Presented in the Notice

Prioritize understanding the specifics outlined in the letter, including the exact amount owed and the specified due date for payment. Take note of any supplementary information or instructions provided to ensure comprehensive comprehension.

- Explore your Payment Options

Deliberate on how you intend to make the payment. When you receive an IRS CP14 Notice and need to address unpaid taxes, there are several payment options available to you:

- Pay the Full Amount at Once

The simplest option is to pay the entire owed amount in one lump sum by the specified due date mentioned in the notice. - Set Up a Payment Plan

If paying the full amount at once is challenging, you can consider setting up a payment plan with the IRS. This allows you to make smaller, manageable payments over an agreed-upon period.

It’s important to carefully consider your financial situation and choose the payment option that best suits your ability to meet the tax obligation. If you’re unsure or need assistance, contacting the IRS or a tax professional can provide guidance on the most suitable payment plan for your circumstances.

- Check for Special Considerations – Disaster Relief

If you find yourself residing in an area that has been federally declared a disaster zone, there are special considerations and relief measures in place that can significantly impact your obligations regarding the IRS CP14 Notice.

- Federally Declared Disaster Areas

The IRS acknowledges that individuals in disaster-affected areas may face unique challenges. These areas are officially recognized by the federal government as having experienced a significant disaster or emergency. - Extensions for Filing and Payment

One of the primary considerations for individuals in disaster areas is the potential extension for both filing tax returns and making payments. This extension is designed to provide relief to those affected by the disaster, recognizing the additional challenges they may be facing. - Automatic Relief

Importantly, if your address of record is in a federally declared disaster area, you should receive separate Disaster Relief Notices along with your CP14 Notice. This means that you automatically have extra time to both file your tax return and make the payment listed on the CP14 Notice. You don’t need to contact the IRS to get this extra time; it is granted automatically.

It’s crucial to be aware of these special considerations and take advantage of the relief measures provided.

- Address Disagreements Promptly

If you find yourself in disagreement with the contents of the notice, it is imperative to contact the IRS at the earliest opportunity. Being proactive in resolving discrepancies can lead to a quicker resolution of the issue outlined in the CP14 Notice.

What happens if you don’t settle your unpaid taxes after receiving the IRS CP14 Notice?

After the CP14 Notice, the IRS typically sends a series of additional notices if the tax debt remains unpaid. The progression of notices may include:

- CP501 Notice: This is the first reminder notice sent after the CP14, reminding you of the outstanding balance and the need for payment.

- CP503 Notice: If there is still no response, this notice serves as a more urgent reminder, emphasizing the potential consequences of continued non-payment.

- CP504 Notice: This is the final notice before the IRS takes enforcement actions. It warns of the intent to levy assets or garnish wages if the tax debt is not settled.

With that, you know that the IRS typically provides multiple opportunities for the taxpayer to address the unpaid taxes before resorting to more severe collection actions. However, the specific timeline and actions can vary based on individual circumstances.

Conclusion

In a nutshell, the CP14 Notice is the IRS’s way of letting you know about unpaid taxes. Take advantage of online tools, understand the notice details, explore payment options, and be aware of special considerations and potential consequences. Addressing the notice promptly is key to a smoother resolution.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...