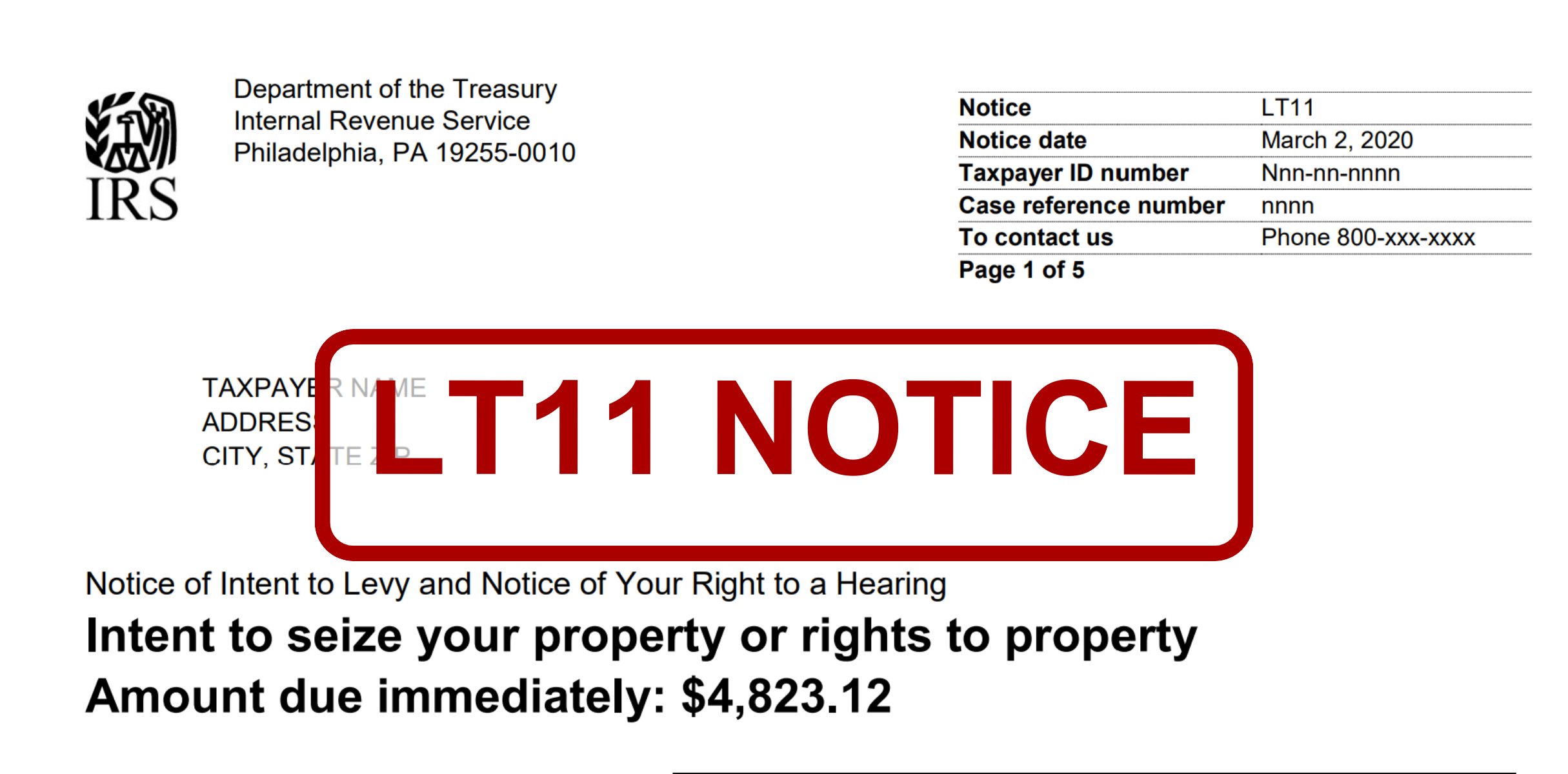

Receiving an IRS LT11 notice or Letter 1058 can undoubtedly elicit concern, yet sorting out the particulars is key to mitigating the associated apprehension. In this blog post, we will explain the contents of this notice, catering to those who may find themselves uncertain about its implications. By delving into the specifics, we aim to provide a comprehensive understanding of the notice’s nuances, so that individuals may navigate their financial obligations with confidence.

Stay with us as we shed light on the significance of grasping the LT11 notice’s content and how it can be instrumental in making informed decisions during this critical phase.

What does an IRS LT11 Notice or Letter 1058 mean?

The IRS LT11 Notice or Letter 1058 are both very similar letters – they are essentially the same message just coming from different departments from within the IRS.

Either way, both the LT11 and 1058 are significant communications from the Internal Revenue Service, indicating that the recipient has overdue taxes and the IRS has yet to receive payment. These notices are a crucial component of the IRS’s efforts to collect outstanding tax liabilities, and which contains a Notice of Intent to Levy and Notice of Your Right to a Hearing.

The letter acts as an official warning to taxpayers, notifying them that their payment for overdue taxes has not been received within the specified timeframe. The primary goal of the LT11 Notice is to prompt immediate action from the taxpayer to address and resolve their outstanding tax obligations.

What are the consequences if the taxes remain unpaid?

The notice explicitly outlines the potential consequences if the overdue taxes are not addressed promptly.

One significant repercussion is the IRS’s intent to seize the taxpayer’s property or rights to property. This is a serious step taken by the IRS to collect the outstanding debt.

The consequences go beyond financial implications, as the notice suggests that failure to respond may lead to further actions, such as the attachment of a levy to wages or bank accounts, and the filing of a Notice of Federal Tax Lien.

These actions can have a profound impact on the taxpayer’s financial stability and creditworthiness.

Recognize the urgency: Responding promptly to the LT11 Notice or Letter 1058

The LT11 Notice and Letter 1058 both underscore the urgency of the situation. Immediate action is crucial to prevent the escalation of consequences. The notice is designed to convey the time-sensitive nature of addressing overdue taxes.

Taxpayers are strongly encouraged to respond promptly by contacting the IRS and taking the necessary steps to either pay the unpaid balance or explore alternative options, such as setting up an installment agreement.

The emphasis on urgency is not only to avoid additional penalties and interest but also to mitigate the risk of more severe actions that the IRS may take if the matter is left unattended. Understanding the critical importance of timely response is key for recipients of the LT11 Notice to navigate the situation effectively and protect their financial standing.

Components of the IRS LT11 Notice

In this section, we’ll examine the crucial components of the IRS LT11 Notice, aiming to provide clear insights for better understanding. From the key sections that specify overdue taxes and potential property seizures to clarifying the language used in the notice, our goal is to deliver concise information. This way, recipients may be empowered with a straightforward analysis, making it easier to navigate the intricacies of this significant communication from the Internal Revenue Service.

Key sections of the notice

Overdue taxes

The LT11 Notice prominently features crucial information about the existence of overdue taxes. This section explicitly specifies the amount owed and the tax period associated with the outstanding debt. The clear identification of the overdue taxes serves as a starting point for the taxpayer to understand the core issue and take appropriate action.

Warning about potential property seizures

Another pivotal aspect highlighted in the notice is the explicit warning regarding the potential seizure of the taxpayer’s property or rights to property. This is a serious consequence if the overdue taxes are not promptly addressed.

By emphasizing the risk of property seizure, the notice aims to convey the urgency and seriousness of the situation, motivating the taxpayer to act swiftly to prevent such drastic measures.

Important terms mentioned in the notice

The language used in the LT11 Notice can be intricate, involving legal and financial terminology. And while they may vary per Notice, below are some terms with their definitions that may commonly be found in such notices:

- Overdue Taxes:

Taxes that you were supposed to pay by a certain date but haven’t paid yet.

- Potential Property Seizure:

The risk that the IRS may take some of your belongings or assets if you don’t pay the taxes you owe. It’s a serious consequence mentioned in the notice to emphasize the urgency of addressing your unpaid taxes promptly.

- Levy:

The IRS taking some of your belongings or money to cover the taxes you owe.

- Installment Agreement:

A plan that lets you pay your owed taxes in smaller, more manageable amounts over time.

- Notice of Federal Tax Lien (NFTL):

A notice to tell others that the government has a claim on your property because of unpaid taxes.

- Collection Due Process (CDP) Hearing:

A formal process where you can argue against certain actions the IRS wants to take, like taking your money or property.

- Fast Track Mediation:

A quicker way to resolve disputes with the IRS through a facilitated discussion.

- Proof of Payment:

Documents or evidence showing that you’ve already paid some or all of your owed taxes.

- Fixed and Determinable Income:

Money you regularly receive that is predictable and consistent.

- Installment Agreement Request:

A formal ask to the IRS to let you pay your owed taxes in smaller, regular amounts.

- Collection Statute Expiration Date (CSED):

The date after which the IRS can’t legally make you pay the owed taxes.

- Certificate of Release of Federal Tax Lien:

A document from the IRS saying they no longer claim your property due to unpaid taxes.

- Taxpayer Advocate Service:

An independent group within the IRS that helps you solve problems and ensures fair treatment.

What are the common concerns and misconceptions on the LT11 Notice and Letter 1058?

Common concerns and misconceptions about the IRS LT11 Notice or Letter 1058 can arise due to the complex nature of tax-related matters. Below are some of the typical concerns and misconceptions about this notice.

Misconceptions:

1. The Notice Is a Scam

Recipients might worry that the notice is a fraudulent attempt to scam them.

The LT11 Notice is an official letter from the IRS. It’s crucial to verify the authenticity of any letter received but dismissing it outright as a scam without proper verification can lead to serious consequences.

2. No Options for Resolution

Taxpayers may believe that they have no options for resolving the tax issue outlined in the notice.

The notice often provides information on payment options, installment agreements, and appeal processes. Understanding and exploring these options can help address the outstanding tax debt.

3. No Room for Negotiation

Taxpayers might assume that the IRS is unwilling to negotiate terms.

The IRS may be open to negotiation, especially through installment agreements or other arrangements. Communication and cooperation can often lead to more manageable solutions.

Concerns:

1. Immediate Property Seizure

Taxpayers might worry that their property will be seized immediately after receiving the notice.

While the notice warns about potential property seizure, the IRS typically follows a process, and immediate seizure is not the first course of action. It’s essential to respond promptly and explore payment options to avoid such severe measures.

2. Unmanageable Penalties and Interest

Taxpayers may worry that the penalties and interest on the overdue taxes will be unmanageable.

Taking prompt action can stop the accrual of additional penalties and interest. Exploring payment options can help manage the overall financial impact.

3. Ignoring the Notice Will Make It Go Away

Some taxpayers may think that ignoring the notice will make the issue disappear.

Ignoring the notice can lead to more severe consequences, such as property seizure or legal actions. It’s crucial to respond promptly and address the outstanding tax obligations.

4. Lack of Understanding of Legal Terms

Recipients may struggle to understand the legal and financial terms used in the notice.

Seeking clarification or professional advice is essential. Additionally, resources may be available to explain the terms and guide taxpayers through the resolution process.

- 5. Immediate Consequences for Non-Payment

Taxpayers may fear immediate, severe consequences for non-payment.

While the notice emphasizes urgency, the IRS typically follows a process. Responding promptly and exploring options can prevent more severe actions.

Addressing these concerns and misconceptions involves careful consideration of the notice’s content, seeking professional advice if needed, and taking proactive steps to resolve the outstanding tax obligations.

Final Thoughts

The IRS LT11 Notice and Letter 1058 are both far more than a bureaucratic formality; they act as a vital alert signaling recipients about overdue taxes and compelling an immediate response. This formal communication serves as a potent call to action, bringing with it profound consequences.

Recognizing the seriousness of unpaid taxes is crucial; the notice not only signals potential property seizure but also delineates repercussions that stretch beyond financial impacts. These consequences encompass creditworthiness implications and the prospect of actions like wage or bank account levies, along with the filing of a Notice of Federal Tax Lien.

The urgency embedded in the notice goes beyond a mere suggestion; it represents a pivotal step to stave off the escalation of consequences. Responding promptly is imperative to tackle overdue taxes and steer clear of additional penalties, interest accruals, and more severe IRS actions.

Successfully navigating this process demands comprehension, diligence, and timely action. When individuals receive the LT11 Notice or Letter 1058, seeking professional advice and utilizing available resources can significantly ease the path to resolution. It’s not just about settling unpaid taxes; it’s a strategic move to safeguard financial stability and plot a course towards a more secure financial future.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...