*** Read the recent IRS update on ERC processing as of June 20, 2024

Many business owners who submitted ERC claims and are still waiting on their credit to be awarded as of early 2024. Let’s take a look at the current situation as relates to ERC processing times.

On September 14, 2023 the IRS announced that they have paused new Employee Retention Credit (ERC) claims until year’s end to combat fraud and protect small businesses from scams. This moratorium follows concerns over ineligible claims being filed, often due to aggressive marketing.

While claims submitted before this halt will still be processed, businesses should expect longer review times due to increased fraud prevention efforts.

Why is there a processing slowdown on ERC claims?

The pause (“moratorium”) on submitting new claims is combined with an intentional slowdown on processing existing claims. This will enable the IRS to provide training to its staff in order to better detect fraudulent claims, as well as to allow more time to review the claims themselves. The IRS deems this necessary due to the large volume of fraudulent and claims often driven by overly-aggressive marketing companies that well selling the idea of “free money” to small business owners.

In the announcement, IRS Commissioner Danny Werfel highlighted the agency’s focus on auditing and investigating suspicious claims and the active pursuit of criminal cases against fraudulent promoters. To help affected businesses, the IRS plans to introduce a settlement program for improper ERC payments and a withdrawal option for unprocessed claims to avoid penalties.

The crackdown includes enhanced training for auditors and a partnership with the Justice Department to address fraud. Businesses are advised to consult trusted tax professionals rather than marketers to assess their eligibility for the ERC, especially given the complex criteria and potential financial risks of submitting incorrect claims.

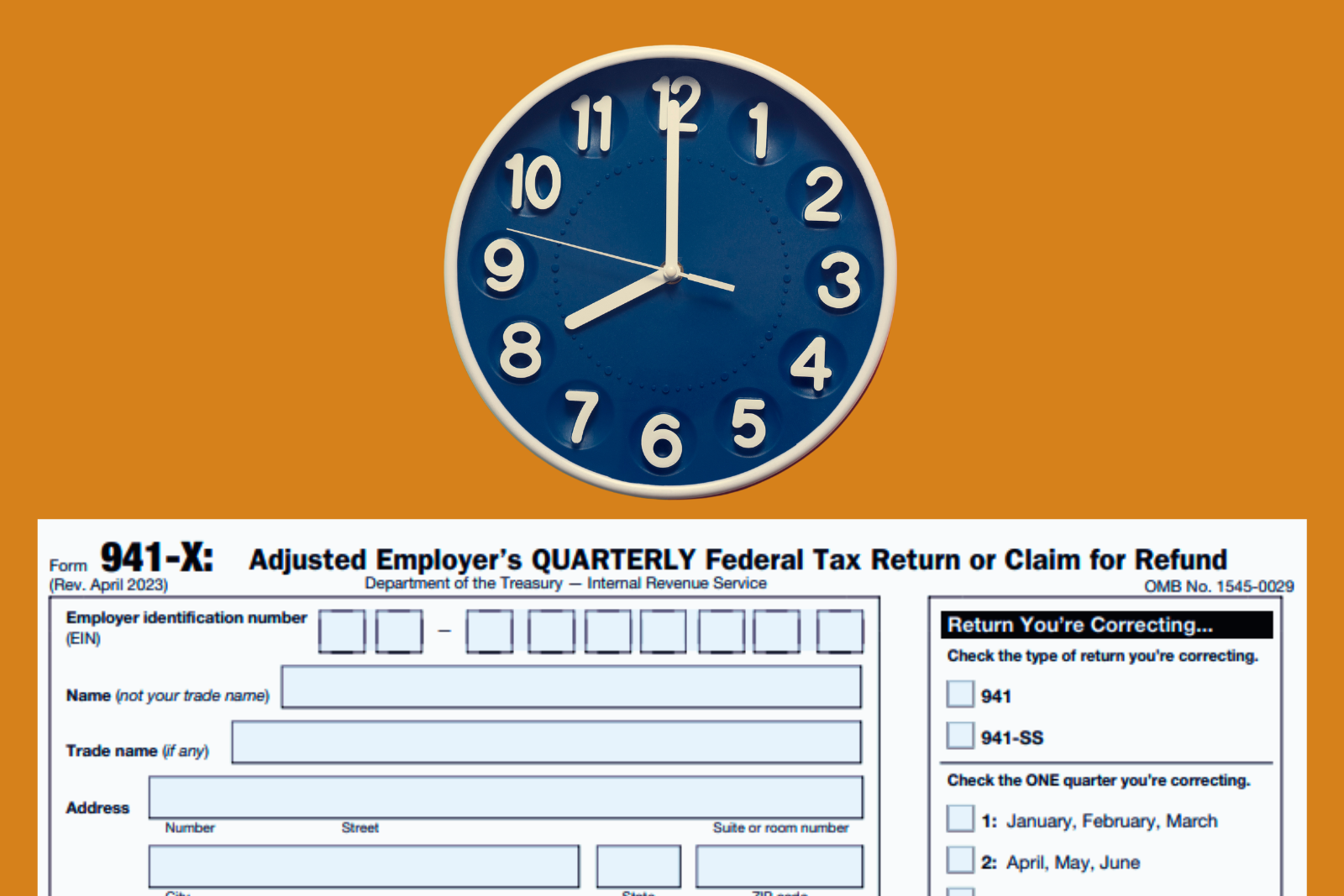

So how long will it take to receive the ERC credit in 2024?

Previously we had seen estimates from 60 days to 90 days, and in some cases 6 to 10 months. There are even reports of some businesses waiting up to 12 months. And as these were all submitted prior to the slowdown in processing, its possible that some businesses who got their claims in just prior to September 14, 2023 may be waiting even longer than that.

However, while the ERC wait times are longer because the IRS is concerned with fraudulent claims, refunds on individual tax returns for 2023 seem to be on a normal processing schedule. Read our article here for the latest updates on individual income tax refunds for 2024.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...