Have you recently moved homes? Or perhaps your business has relocated to a new address? In either case, making sure that the IRS has your updated mailing address is crucial to avoid missing important correspondence and tax-related documents.

This is where IRS Form 8822 comes into play. Let’s look at what this form entails and how you can use it effectively.

Understanding Form 8822

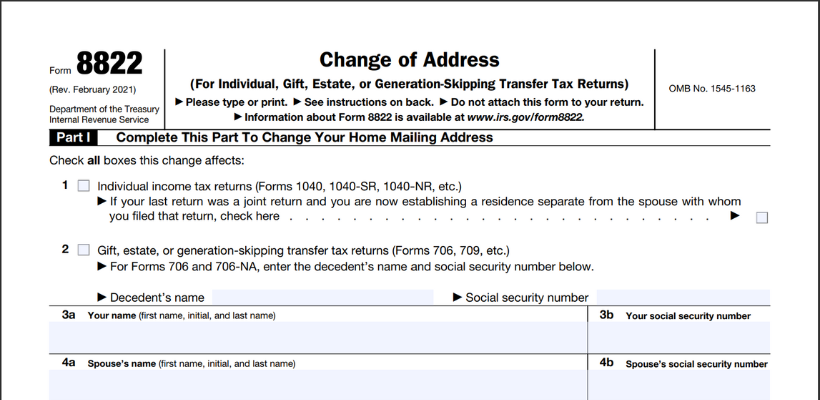

Form 8822, officially titled “Change of Address,” serves as a notification tool for individuals or entities to inform the Internal Revenue Service (IRS) about any changes in their home or business mailing address. This form is essential for maintaining accurate records and ensuring that you receive all correspondence and documents from the IRS in a timely manner.

Who Should File Form 8822?

If you’ve recently moved homes or changed your business address, you should file Form 8822 to update the IRS about the change. Additionally, if your change of address affects the mailing address for any dependent children who file income tax returns, separate forms should be filed for each child. It’s essential to keep all addresses current to avoid any disruptions in communication with the IRS.

Filing Procedure

Filing Form 8822 is a straightforward process. Here’s a step-by-step guide to help you through it:

- Get the form

You can download Form 8822 from the IRS website or request a copy by calling the IRS helpline. - Fill out the form

Provide accurate information about your old and new addresses, including your full name or business name, Social Security Number (SSN) or Employer Identification Number (EIN), and signature. - Complete separate forms if necessary

If your change of address affects the mailing address for dependent children who file income tax returns, complete separate forms for each child. - Attach supporting documents

If you are filing on behalf of someone else as their representative, attach a copy of the power of attorney to Form 8822. - Submission

Mail the completed Form 8822 to the IRS address specified in the form’s instructions. Make sure that you keep a copy for your records.

Processing Time

After submitting Form 8822, it typically takes the IRS approximately four to six weeks to process the change of address. During this period, it’s advisable to monitor your mail carefully and follow up with the IRS if necessary to confirm that your address update has been successfully processed.

Business Address Changes: Form 8822-B

For individuals or entities looking to change their business address, the IRS offers Form 8822-B specifically for this purpose. Similar to Form 8822, this form ensures that the IRS has accurate information for sending correspondence related to your business.

Final Thoughts

Keeping your mailing address updated with the IRS is essential for staying informed about tax-related matters and avoiding potential issues. Form 8822 provides a simple and effective way to notify the IRS of any changes in your home or business address.

By following the outlined steps and submitting the form promptly, you can guarantee that your communication channels with the IRS remain uninterrupted, allowing you to stay compliant and informed regarding your tax obligations.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...