Yes, tax liens are public records.

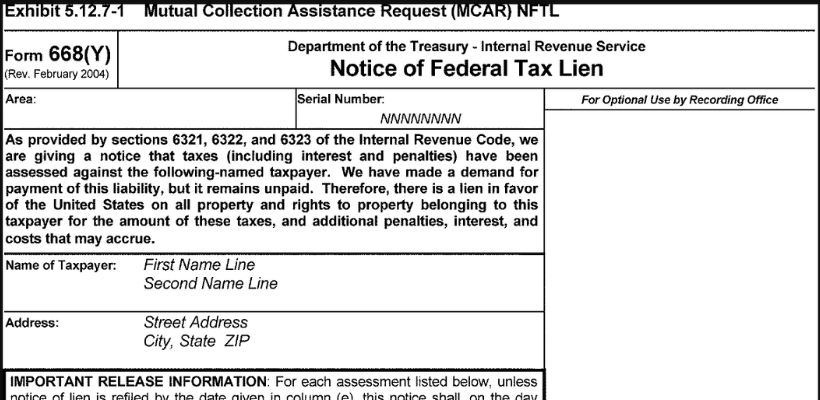

When the IRS files a Notice of Federal Tax Lien, it becomes a public document, signaling that the government has a legal claim against your property due to unpaid tax debts. This public notice serves to inform other creditors that the IRS has a right to your assets, which can impact your credit score and your ability to secure loans.

What is a Federal Tax Lien?

A federal tax lien is essentially the government’s legal claim against your property when you fail to pay your tax debt. This lien affects all your property, including real estate, personal belongings, and financial assets.

The lien arises after the IRS assesses your tax liability, sends you a bill (Notice and Demand for Payment), and you neglect or refuse to pay the debt on time.

Public Notice and Its Implications

The IRS files the Notice of Federal Tax Lien to make the lien known to other creditors. This notice is filed with local government offices and becomes a matter of public record.

Once this notice is filed, it can affect several aspects of your financial life:

- Assets

The lien attaches to all your assets and any future assets acquired while the lien is in effect. - Credit

The public notice can limit your ability to obtain credit as it signals potential risk to lenders. - Business

If you own a business, the lien attaches to all business property and rights, including accounts receivable. You will not be able to sell your business while the lien is attached, and likely will have difficulty securing loans with an active IRS tax lien on your business. - Bankruptcy

Filing for bankruptcy does not necessarily remove the lien, and your tax debt may continue post-bankruptcy.

Final Thoughts

Tax liens are indeed public records, serving as a notice to creditors about the government’s claim against your property due to unpaid taxes. To effectively address the implications, it’s important that you be proactive in managing your tax obligations, thus avoiding the adverse effects of a tax lien on your financial well-being.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...