Are you struggling with mounting tax debt? The IRS Fresh Start Program, also known as the Fresh Start Initiative, could be your solution.

At the Law Office of Steven N. Klitzner, we understand the challenges individuals and businesses face when dealing with tax obligations. Our experienced team is dedicated to guiding you through the Fresh Start Program, offering options designed to provide significant financial relief and help you regain control of your finances.

What is the IRS Fresh Start Program?

The IRS Fresh Start Program is a comprehensive initiative aimed at assisting taxpayers who are burdened by tax debt. Launched to offer more manageable solutions and relief options, the program includes several key components designed to address different aspects of tax liability and provide a pathway to financial recovery.

The program reflects the IRS’s commitment to offering relief to taxpayers in difficult financial situations, making it more accessible and practical for those who need it most.

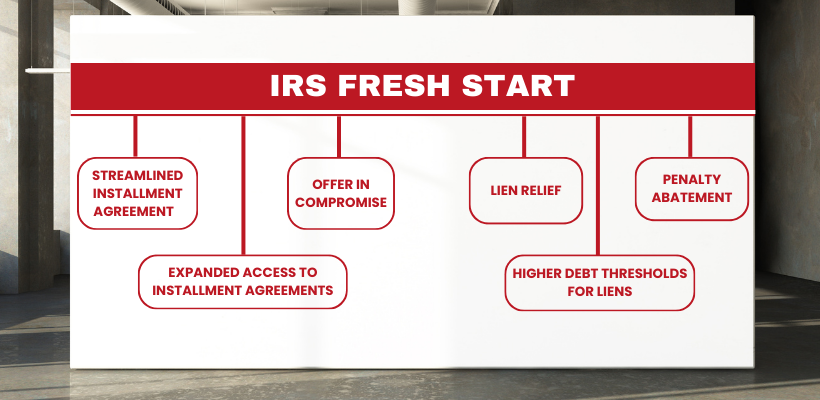

Key Components of the Fresh Start Initiative

Below are the key components of the IRS Fresh Start Program.

1. Streamlined Installment Agreements

The Streamlined Installment Agreement is designed for taxpayers who owe up to $50,000 in taxes. Under this arrangement, you can establish a manageable payment plan without the burden of submitting a detailed financial statement. This simplifies the process and makes it easier for eligible taxpayers to get back on track.

How it works: You will agree to a monthly payment amount based on your tax liability and financial situation. This payment plan can be extended up to 72 months, providing significant flexibility.

Eligibility: To qualify, your total tax liability, including penalties and interest, must not exceed $50,000. You must also be current with your tax filings.

2. Offer in Compromise (OIC)

The Offer in Compromise allows taxpayers to settle their tax debt for less than the full amount owed. The Fresh Start Program has broadened the criteria for eligibility, making it more attainable for those experiencing financial difficulties.

What it is: An Offer in Compromise is a settlement agreement between you and the IRS to resolve your tax debt for a lesser amount.

Eligibility: The IRS considers various factors, including your ability to pay, income, expenses, and asset value. The Fresh Start Program has made it easier to demonstrate financial hardship and qualify for this option.

Application Process: You’ll need to submit Form 656, along with a detailed statement of your financial situation, to support your offer.

3. Lien Relief

Federal tax liens can severely impact your financial situation and credit score. The Fresh Start Program offers relief by allowing the IRS to withdraw a Notice of Federal Tax Lien under certain conditions.

How it works: If you enter into a direct debit installment agreement or pay off your tax debt, you may be eligible for lien withdrawal.

Eligibility: The IRS will generally withdraw a lien if you have met the terms of your payment agreement and your balance is paid in full.

4. Penalty Abatement

Penalty relief is available for taxpayers who qualify under specific conditions, such as economic hardship or unforeseen circumstances.

Types of penalties: The program addresses failure-to-pay and failure-to-file penalties, which can significantly increase your tax debt.

Eligibility: For example, if you have been unemployed for 30 consecutive days or more, you may qualify for a six-month grace period on failure-to-pay penalties. The IRS also considers reasonable cause for penalty abatement.

5. Higher Tax Debt Threshold for Lien Filing

The Fresh Start Program has raised the threshold for when the IRS files a Notice of Federal Tax Lien, aiming to reduce the burden on taxpayers with lower tax liabilities.

Threshold Increase: The IRS will typically not file a lien if the unpaid balance is less than $10,000, providing relief to those with smaller tax debts.

Impact: This change helps protect taxpayers from having a lien filed against them for smaller amounts, which can reduce stress and improve financial stability.

6. Expanded Access to Installment Agreements

Small businesses facing tax debt have greater access to installment agreements under the Fresh Start Program.

Eligibility: Businesses with tax debts of $25,000 or less can now apply for installment agreements more easily.

Process: These businesses can set up payment plans without submitting a detailed financial statement, simplifying the process and making it more accessible.

Eligibility for the Fresh Start Program

Eligibility for the IRS Fresh Start Program varies depending on the specific relief option. Generally, taxpayers must demonstrate financial hardship and meet certain criteria to qualify for various components of the program.

- Income and financial criteria: The program includes income thresholds and financial criteria to determine eligibility. This includes reviewing your total tax liability, ability to pay, and overall financial situation.

- Types of taxpayers: The program is available to individuals, self-employed individuals, and small businesses. Each group has specific requirements and documentation needs.

How to apply for the Fresh Start Program

- Determine your eligibility.

Assess your financial situation and tax liability to see if you qualify for any components of the Fresh Start Program. Understanding your eligibility is the first step in the application process. - Gather necessary documentation.

Collect all relevant financial documents, such as income statements, tax returns, and details of your assets and liabilities. Accurate documentation is crucial for a successful application. - Complete required forms.

Depending on the relief option you are seeking, complete the necessary IRS forms. For an Offer in Compromise, you will need Form 656. For installment agreements, Form 433-A or 433-B may be required. - Submit your application.

Ensure all forms are correctly filled out and submitted to the IRS. Adhere to any deadlines and follow submission guidelines to avoid delays.

Maintain communication with the IRS to track the status of your application. Prompt follow-up can help ensure your application is processed in a timely manner.

Why should you consider applying for the IRS Fresh Start Program?

The Fresh Start Program offers several benefits to eligible taxpayers, providing relief and support in managing tax debt.

- Peace of mind. The program offers a structured approach to dealing with tax debt, reducing stress and providing a clearer path to resolution.

- Financial relief. With manageable payment plans and reduced debt amounts, the program helps alleviate financial pressure.

- Improved credit scores. Removal of tax liens can enhance your credit rating and financial stability.

Is the IRS Fresh Start Program For You?

Don’t let tax debt hold you back. With this new program, relief is within reach. At the law office of Steven N. Klitzner, we specialize in navigating the complexities of tax law and we are here to guide you every step of the way.

Let’s work together to explore the options available under the Fresh Start Initiative and find the best solution for your unique situation. Take the first step towards financial freedom today by contacting us for a personalized consultation. Together, we can help you achieve lasting tax relief and pave the way for a brighter financial future.

Call us at (305) 564-9199 or fill our website contact form to schedule a free and confidential consultation today!