If you owe taxes to the IRS, you might be asked to fill out something called Form 433. But here’s the catch: there isn’t just one. And they’re not a one-size-fits-all. So which one do you need? And what is the difference between them? This post will walk you through what each form is used for and help you figure out which one you might need.

What is IRS Form 433?

In its various formats, IRS Form 433 is a Collection Information Statement. It helps the IRS get a clear picture of your finance. It tells them about your income, assets, expenses, and debts, so they can figure out how (or if) you can pay your outstanding tax liability.

These forms are commonly required when:

- You’re applying for an installment agreement.

- You’re submitting an Offer in Compromise (OIC).

- You’re requesting to be placed in Currently Not Collectible status.

- The IRS needs to evaluate your ability to pay.

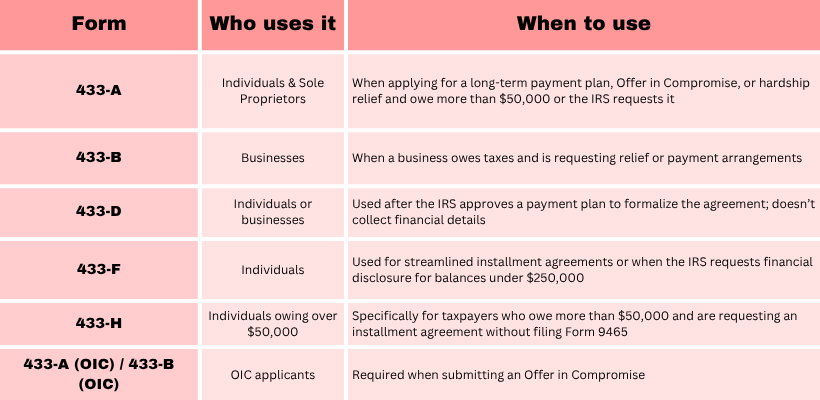

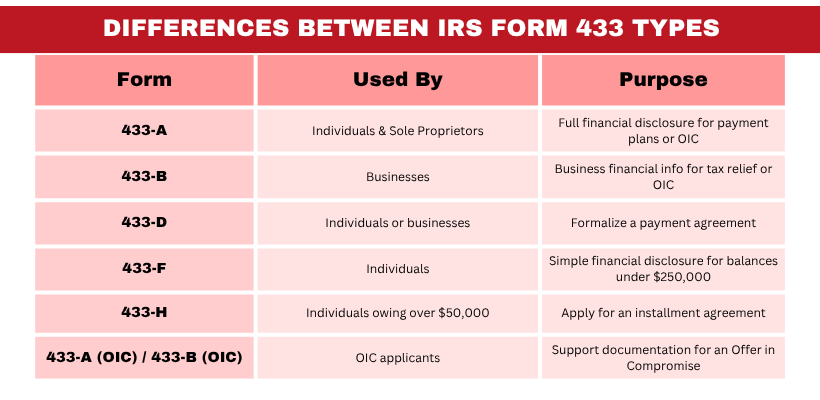

Now, let’s take a closer look at the different versions of Form 433.

IRS Form 433-A: For Wage Earners and Self-Employed Individuals

This is the most detailed version for individuals. Form 433-A is used when you are a wage earner or self-employed, and are either:

- Applying for an Offer n Compromise

- Owe more than $50,000, or

- The IRS has specifically requested a full financial disclosure.

When filing this form, you will be required documentation of your income, bank accounts, property, and expenses.

IRS Form 433-B: For Businesses

If you’re representing a corporation, partnership, or LLC, this is the form you’ll use. Form 433-B collects financial details about your business operations, such as:

- Monthly income and expenses

- Business assets and liabilities

- Accounts receivable

This form is often used in cases where a business is trying to negotiate payment terms with the IRS or submit an Offer in Compromise.

IRS Form 433-D: Finalize an Installment Agreement

Unlike the others, this form is not about asking for a payment plan. This is used for formalizing a payment plan that the IRS has already approved. Form 433-D is where you agree to the terms:

- how much you’ll pay

- when you’ll pay, and

- how you’ll pay (such as direct debit)

This form does not ask for financial details.

IRS Form 433-F: The Simple Version

This version is often used when taxpayers owe less than $250,000 and want to set up a streamlined installment agreement. Compared to Form 433-A, it’s much shorter and less intrusive.

If you’re not self-employed and you qualify for a simplified payment plan, the IRS may accept Form 433-F instead of the more complex versions.

IRS Form 433-H: For Installment Agreements Over $50,000

Form 433-H is designed for individuals who owe more than $50,000 (but less than $250,000) and want to apply for an installment agreement directly—without having to fill out Form 9465 separately.

It includes both a payment request and a mini financial disclosure, somewhere between the complexity of 433-F and 433-A.

Forms for Offers in Compromise (OIC): 433-A (OIC) and 433-B (OIC)

If you’re trying to settle your tax debt for less than you owe through an Offer in Compromise, you’ll need a special version of Form 433:

- Use Form 433-A (OIC) if you are an individual

- Use Form 433-B (OIC) if you’re a business

These forms are submitted along with Form 656 and they help the IRS assess your ability to pay based on “reasonable collection potential”.

Final Thoughts

While all of these forms fall under the “Form 433” umbrella, each one serves a distinct purpose. Submitting the wrong form or filling one out incorrectly can delay your relief options. If you’re facing a serious tax problem, it’s smart to get help navigating these requirements.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...