Tax season can be a daunting time for many individuals and businesses alike, especially when faced with the challenge of paying off tax liabilities in a lump sum. Fortunately, the IRS offers a practical solution in the form of IRS Form 9465, also known as the Installment Agreement Request. This form provides taxpayers with a structured way to pay off their tax debt over time, making it more manageable and less financially burdensome.

What is IRS Form 9465?

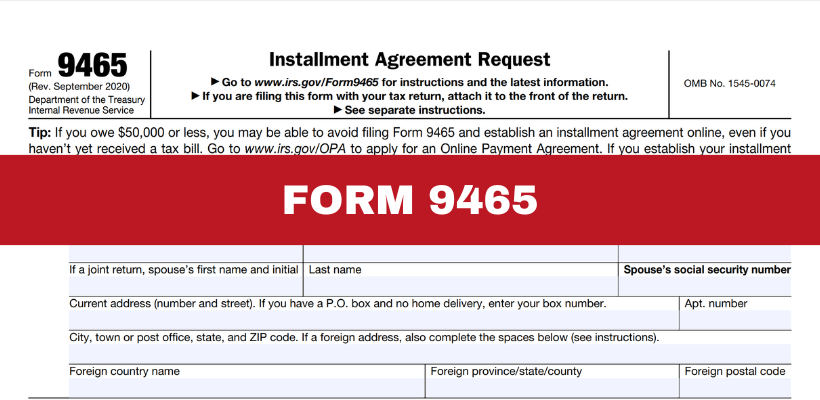

IRS Form 9465 is essentially a formal request to the Internal Revenue Service (IRS) to allow you to pay your tax debt in monthly installments rather than in one lump sum. This option is particularly beneficial for those who are unable to pay their entire tax bill immediately upon filing their tax return. By submitting this form, you are proposing a payment plan that fits within your financial capabilities.

Who can use Form 9465?

Form 9465 is available to individual taxpayers, businesses, and even those who are self-employed. However, there are certain criteria and conditions that must be met:

- Tax Debt Amount

You can use Form 9465 if you owe $50,000 or less in combined individual income tax, penalties, and interest. If your debt exceeds this amount, additional documentation and approval may be required. - Tax Return Filing

Ensure that all required tax returns have been filed before submitting Form 9465. This includes current year returns and any outstanding prior years’ returns. - Payment Capacity

You must demonstrate to the IRS that you are unable to pay the full amount owed immediately. This can be done by providing details of your financial situation, income, expenses, and assets.

How to Complete Form 9465?

Filling out Form 9465 is relatively straightforward, but attention to detail is crucial to avoid delays or misunderstandings. Here are the basic steps:

- Personal Information: Provide your name, address, Social Security Number (or Employer Identification Number for businesses), and other identifying details.

Type of Tax and Period: Specify the type of tax (individual, business, payroll, etc.) and the tax period for which you owe. - Payment Plan Details: Indicate the amount you propose to pay monthly and the day of the month you prefer the payment to be due. The IRS typically expects you to propose the highest monthly payment you can afford without causing undue financial hardship.

- Bank Account Information: Include your bank account details if you choose to set up a direct debit from your bank account each month. This option often streamlines the process and ensures timely payments.

Where should you send Form 9465?

Once completed, Form 9465 should be sent to the IRS along with any required documentation, such as your most recent tax return and financial statements. The mailing address for submitting Form 9465 can vary depending on your location and whether you are including a payment with the form. Typically, you can find the correct address on the IRS website or by calling their customer service line.

Final Thoughts

IRS Form 9465 is a practical solution for taxpayers who are unable to pay their tax obligations in full at the time of filing. By requesting an installment agreement, you can spread your payments over time, making it easier to manage your finances while fulfilling your tax responsibilities. Remember, timely communication and accurate information are key to dealing with the tax system effectively.

If you have questions or need assistance with Form 9465, consulting a tax professional or contacting the IRS directly can provide the guidance you need to achieve financial compliance with confidence. Part of our services at the Law Office of Steven N. Klitzner include helping taxpayers set up installment agreements with the IRS. We are here to assist you in navigating the complexities of the tax system and ensuring a smooth process.

Call us today at (305) 564-9199 or fill out our website contact form to schedule a free and confidential consultation.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...