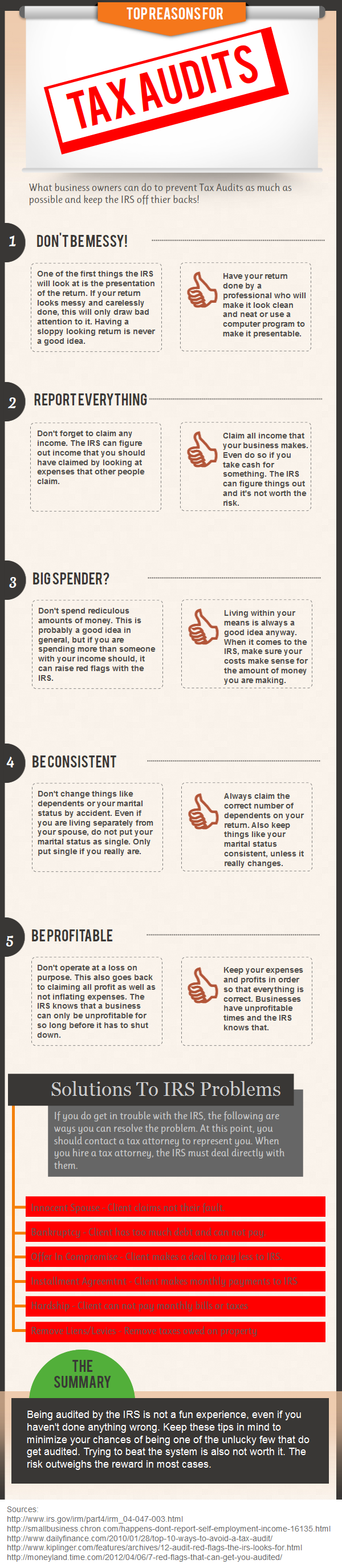

Below is an illustration explain IRS tax audits. There is a certain percentage of people every year that is going to be audited. Certain triggers can cause it to be more likely that a business owner or individual is chosen for an IRS audit. Avoid doing the negative things on this list as much as possible to keep from being audited. Try to do the right thing with the IRS that will keep you from being audited. Even if you are innocent and have done nothing wrong, being audited by the IRS is not fun.

Ⓒ 2024 Steven N. Klitzner. All rights reserved. | Privacy Policy | Terms of Service | Website by Vocational Media

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...