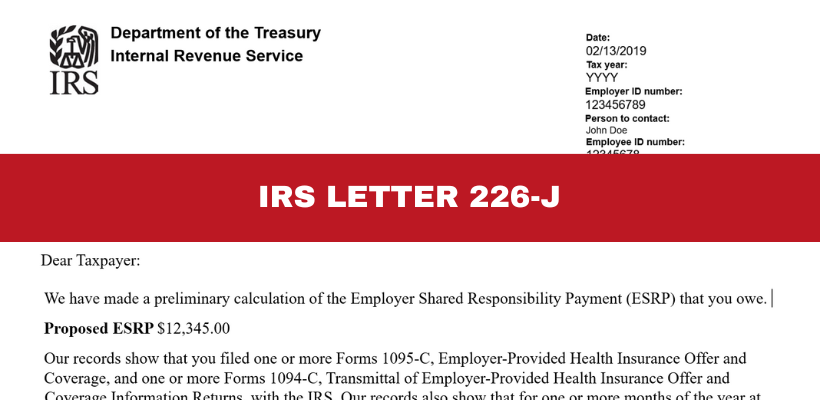

IRS Letter 226-J is a notification sent by the IRS to employers who may owe an Employer Shared Responsibility Payment (ESRP) under the Affordable Care Act (ACA). This letter is essentially a bill from the IRS indicating that they believe the employer did not meet ACA requirements for providing affordable and adequate health insurance to their employees.

If you’ve received this letter, it’s important to understand what it means, why you’re receiving it, and how to respond effectively.

Why did I receive IRS Letter 226-J?

The IRS sends Letter 226-J when it determines that your organization might not have complied with the ACA’s Employer Mandate. Specifically, this could mean:

- Your organization did not offer health insurance to 95% of its full-time employees and their dependents.

- The health insurance provided was not considered affordable or did not meet the ACA’s minimum essential coverage standards.

The letter includes a proposed ESRP amount based on information your organization submitted via Forms 1094-C and 1095-C. If even one employee purchased health insurance through the Health Insurance Marketplace and received a premium tax credit, your organization might be assessed an ESRP.

Who receives IRS Letter 226-J?

Typically, only Applicable Large Employers (ALEs)—those with 50 or more full-time employees or full-time equivalents—are subject to the ACA’s Employer Mandate. If your business falls into this category and the IRS identifies gaps in your compliance, you may receive this letter.

Small businesses with fewer than 50 full-time employees are generally not subject to this mandate and would not receive Letter 226-J unless there’s an unusual reporting issue.

What should I do if I receive IRS Letter 226-J?

Receiving IRS Letter 226-J can feel overwhelming, but the key is to act quickly and carefully. Here’s a step-by-step guide:

- Review the information provided.

- Read the letter thoroughly to understand the IRS’s findings.

- Cross-check the IRS’s calculations with your records, especially Forms 1094-C and 1095-C.

- Look for any errors or discrepancies in the employee data or insurance information.

- Respond within 30 days.

- You have 30 days from the date of the letter to respond.

- Ignoring the letter will not make the issue go away and could lead to further penalties or enforcement actions.

- Decide whether to agree or dispute.

- If you agree: Follow the instructions in the letter to pay the proposed ESRP amount.

- If you disagree: Provide supporting documents to challenge the assessment.

What documentation should be included?

If you decide to dispute the ESRP assessment, you’ll need to gather and submit documentation that supports your case. Key documents include:

- Forms 1094-C (Transmittal of Employer-Provided Health Insurance Offer and Coverage Information) and 1095-C (Employer-Provided Health Insurance Offer and Coverage).

- Records of employee health insurance plans, including details on coverage and costs.

- Affordability calculations that show how the coverage met ACA requirements.

- Evidence of any communications with employees about their health insurance options.

The more organized and complete your documentation, the stronger your case will be.

How do I respond to IRS Letter 226-J?

The IRS provides clear instructions in the letter for submitting your response, whether by mail or fax. When responding:

- Include all requested forms and supporting documents.

- Use the provided ESRP Response Form to indicate whether you agree or disagree with the proposed assessment.

- Double-check that all documents are accurate and legible.

- Follow up with the IRS if you do not receive a confirmation within a few weeks of your submission.

If you need more time to respond, you can request an extension by contacting the IRS. However, this should only be done if absolutely necessary, as delays can increase the risk of penalties.

What happens after I respond to the IRS letter?

Once the IRS receives your response, they will review your submission and either:

- Accept your corrections or adjustments and revise the ESRP amount accordingly.

- Confirm the original ESRP amount if your documentation does not support your claim.

You’ll receive a follow-up letter with their decision. If you still disagree, you may escalate the matter by requesting an appeal.

Final Thoughts

Receiving IRS Letter 226-J can feel intimidating, but it doesn’t mean you’re automatically at fault. By responding promptly, reviewing the details carefully, and providing accurate documentation, you can address the issue effectively.

If you’re unsure how to proceed or need expert guidance, don’t hesitate to seek professional assistance. At the Law Office of Steven Klitzner, we specialize in helping employers navigate complex IRS issues, including ESRP assessments. Contact us today to schedule a free and confidential consultation. We’ll help you protect your business and ensure compliance with ACA regulations.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...