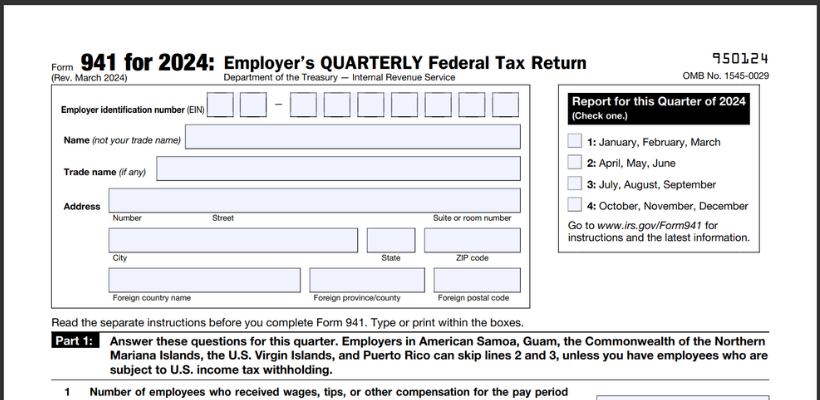

For many businesses, dealing with taxes can often feel like a puzzle, filled with complex forms and ever-changing regulations. Among the multitude of documents employers need to grapple with is IRS Form 941, also known as the Employer’s Quarterly Federal Tax Return.

This form serves as a crucial tool for businesses to report income taxes, Social Security tax, and Medicare tax withheld from employees’ paychecks, as well as to pay the employer’s portion of Social Security and Medicare taxes. Let’s take a look at the details of Form 941 and what employers need to know about it.

What is Form 941?

Form 941 covers various tax obligations that employers must fulfill on a quarterly basis. These include reporting wages paid, tips received by employees, federal income tax withheld, and both employer and employee shares of Social Security and Medicare taxes.

Also, this filing accounts for adjustments to Social Security and Medicare taxes, along with certain tax credits like the qualified small business payroll tax credit for increasing research activities.

What’s New in IRS Form 941 for 2024?

As with any tax document, staying up-to-date with changes is paramount. In 2024, some noteworthy updates have been made to Form 941. For instance, the Social Security tax rate remains at 6.2% for both employees and employers, with a wage base limit of $168,600. The Medicare tax rate stays at 1.45% for both parties, with no wage base limit. Furthermore, specific COVID-19 related credits for qualified sick and family leave wages have expired, signaling a shift in the tax landscape for employers.

Who Must File Form 941?

The obligation to file Form 941 falls on employers who pay wages subject to federal income tax withholding or Social Security and Medicare taxes. However, certain exceptions exist, such as for employers notified to file Form 944 annually, seasonal employers, household employers, and employers of farm workers. It’s crucial for businesses to ascertain their filing requirements accurately to avoid non-compliance issues.

Where to mail Form 941?

If you are wondering where to mail Form 941, worry not as the IRS has provided information on mailing addresses for Form 941. Depending on which state you are filing from and if you are sending payment with your form or not, the IRS provides the specific mail-to addresses for your Form 941 and/or payment.

When Must You File?

The timeline for filing Form 941 follows a quarterly cycle, with deadlines falling at the end of each quarter. Typically, employers must file their initial Form 941 for the quarter in which they first paid wages subject to Social Security and Medicare taxes or federal income tax withholding. Subsequent filings are required for every quarter thereafter, even if no taxes are due, unless exempted due to specific circumstances.

Timely filing is crucial, with penalties imposed for late submissions.

With a clear grasp of IRS Form 941 and its requirements, businesses can manage this aspect of their financial obligations with confidence and efficiency. By staying informed, maintaining accurate records, and adhering to filing deadlines, employers can fulfill their tax obligations seamlessly.

You can find the 2024 revised IRS Form 941 here.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...