When you take on the role of a fiduciary—such as an executor of an estate, a trustee of a trust, or a guardian for a minor or incapacitated person—you assume significant legal responsibilities. One of these responsibilities includes managing tax matters on behalf of the individual or entity you represent. IRS Form 56, known as the Notice Concerning Fiduciary Relationship, is a critical document that formally informs the IRS of your fiduciary role, ensuring that the right person handles the tax obligations and financial affairs associated with that role.

What is IRS Form 56 and why is it important?

IRS Form 56 serves a vital function: it officially notifies the IRS that a fiduciary relationship has been established. This means that a designated individual is now responsible for managing the financial and tax matters of another person, estate, or trust.

Filing this form is crucial because, without it, the IRS may not recognize the fiduciary as the official representative authorized to make decisions or file returns on behalf of the entity or individual. In essence, Form 56 is your key to ensuring that the IRS acknowledges your authority in handling tax-related responsibilities.

Who should file IRS Form 56?

Form 56 must be filed by anyone appointed as a fiduciary. This includes:

- Executors of estates: Individuals tasked with managing the estate of a deceased person.

- Trustees of trusts: People who oversee the assets placed in a trust and ensure that the terms of the trust are fulfilled.

- Guardians for minors or incapacitated individuals: Those responsible for managing the financial affairs of individuals who cannot do so themselves.

By filing this form, fiduciaries gain the legal authority to act on behalf of the entity in all tax-related matters, providing clarity and protection for both the fiduciary and the individual or entity they represent.

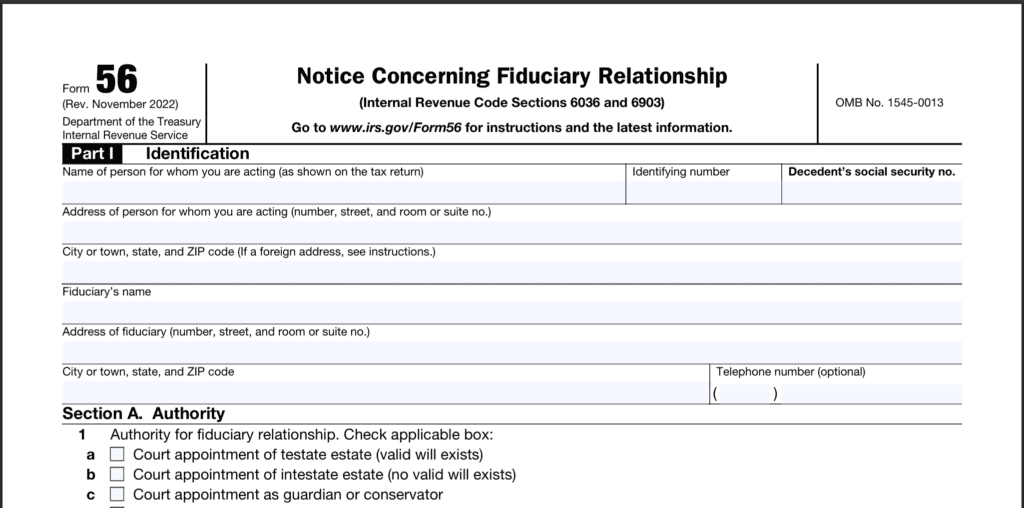

How to Complete IRS Form 56

Filling out IRS Form 56 involves a few straightforward steps:

- Provide information of entity: Include the name and taxpayer identification number (TIN) of the individual or entity for whom you are acting as a fiduciary.

- Your Information: Enter your name, address, and contact details so that the IRS knows who is responsible for managing the tax matters.

- Specify the Fiduciary Relationship: Clearly indicate the type of fiduciary relationship you have—whether you are an executor, trustee, or guardian.

- Important Dates: Note the date the fiduciary relationship began, as this is important for record-keeping.

- Entity Type: Specify the type of entity you are representing (individual, trust, etc.).

Additional Documents You May Need

When submitting IRS Form 56, it’s advisable to attach legal documents that establish your fiduciary authority. These documents may include:

- Wills: If you are an executor, a copy of the will can validate your authority.

- Trust Documents: For trustees, include the trust agreement that outlines your role.

- Court Orders: Guardians may need to provide court documents that confirm their appointment.

These supporting documents help verify your legal right to manage the entity’s tax matters and may prevent delays or complications in processing your form.

Where and how to submit IRS Form 56

To submit IRS Form 56, you must mail it to the appropriate IRS service center, depending on the type of return you are handling. Unfortunately, there is no option for electronic or fax submission for this form, so ensure you send it via regular mail. It’s wise to keep a copy of the completed form and any accompanying documents for your records.

Final Thoughts

Filing IRS Form 56 may seem like just another step in handling someone else’s finances, but it’s actually important for making sure the IRS officially recognizes you as their representative. Submitting this form early on helps prevent any confusion or delays when it comes to tax matters and allows you to manage everything smoothly on behalf of the person or estate you’re responsible for.

By staying organized and taking care of this first step, you’ll set yourself up for success in fulfilling your fiduciary duties, while also helping avoid any tax-related issues down the road.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...