IRS Form 433-F can be a helpful tool if you’re struggling to pay your tax debt in full and need a manageable plan to address what you owe. The IRS uses this form as a simplified way for you to disclose your financial situation—like income, expenses, and major assets—without diving into extensive details unlike form 433-A. Often required when setting up an installment agreement or negotiating payment options, Form 433-F is intended for individuals whose tax cases are straightforward, making the process easier and faster for both you and the IRS.

What is IRS Form 433-F used for?

Form 433-F is designed to give the IRS a snapshot of your financial situation. It includes key details like your income, expenses, and assets. This form is used to:

- Evaluate your ability to pay. The IRS reviews the information you provide to decide if you can pay your tax debt in full or need a payment plan.

- Determine eligibility for payment plans or tax debt relief. In many cases, Form 433-F helps the IRS decide if you qualify for an installment agreement or other relief options.

Because Form 433-F requires less detail than other IRS financial forms, it’s often used in simpler cases or for smaller tax debts where a full disclosure of every asset and expense isn’t needed.

Quick tip: There’s more than one version of IRS Form 433, and each serves its own purpose. If you’re confused about which one to pick, check out our article to get a better idea.

Who should use IRS Form 433-F?

Form 433-F is ideal for taxpayers who:

- Owe back taxes. If you have unpaid taxes and can’t pay the full amount right away, Form 433-F might be the first step to setting up a payment plan.

- Need a basic installment agreement. This form is commonly used when setting up a straightforward installment agreement without complex financial details.

The IRS typically asks for Form 433-F when you owe back taxes, but your case is uncomplicated and doesn’t require the extensive financial details in Form 433-A.

How to fill out IRS Form 433-F

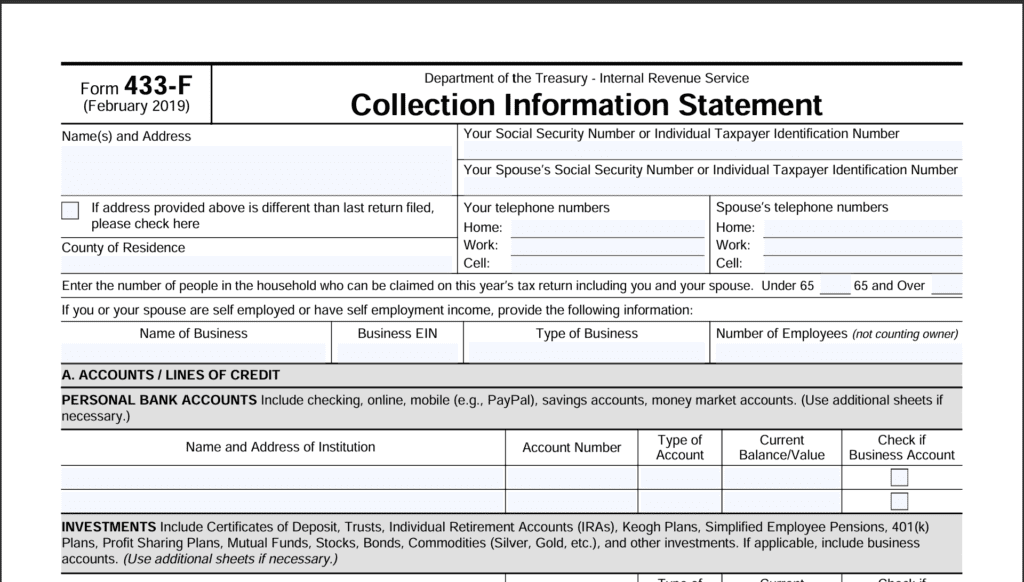

Completing Form 433-F involves gathering some basic information about your finances. Here’s a quick guide to each section:

- Personal and contact information – Start by entering your name, Social Security Number (SSN), and contact details. If you’re married, you may also need to provide your spouse’s information.

- Income and expenses – Provide an overview of your monthly income from all sources, including wages, Social Security benefits, and other income streams. Then, list your monthly living expenses, such as:

- Rent or mortgage

- Utilities (like electricity, gas, water)

- Transportation (car payments, gas)

- Medical costs

This section gives the IRS an idea of your financial commitments and what’s left over each month for debt payments.

- Asset and debt information – Here, you’ll list valuable items you own (assets) and any debts you owe:

- Assets – Include information on your bank accounts, vehicles, real estate, and any other major possessions. You may need to estimate the current value of each asset.

- Debts – List any outstanding debts, like credit card balances, loans, or other amounts you owe.

Filling out these sections accurately is important, as the IRS uses this information to understand your financial limitations and what type of payment plan or relief option might work for you.

What supporting documents are needed?

To verify the information in Form 433-F, the IRS typically requires you to submit certain documents. These documents may include:

- Recent pay stubs – To confirm your income.

- Bank statements – These show your available cash and recent financial activity.

- Mortgage or rent statements – To confirm your housing costs.

- Utility bills – To verify your monthly living expenses.

Providing these documents helps support the numbers on your form, speeding up the IRS’s review and increasing your chances of a quick response.

How to submit IRS Form 433-F

After you complete Form 433-F and gather your supporting documents, you can send it to the IRS by mail or fax, depending on the instructions they provided. If you’re unsure where to send it, check any correspondence from the IRS or their website to confirm the correct address or fax number. Sending all the requested information together helps prevent delays and ensures the IRS has everything they need to review your case.

Final Thoughts

IRS Form 433-F provides a quicker, more streamlined way to share your financial details with the IRS. By completing this form accurately, you can take the first steps toward resolving your tax debt, whether through a manageable monthly payment plan or another arrangement. For taxpayers with less complex financial situations, using Form 433-F can make the process simpler and faster, helping you avoid potential collection actions and focus on a solution.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...