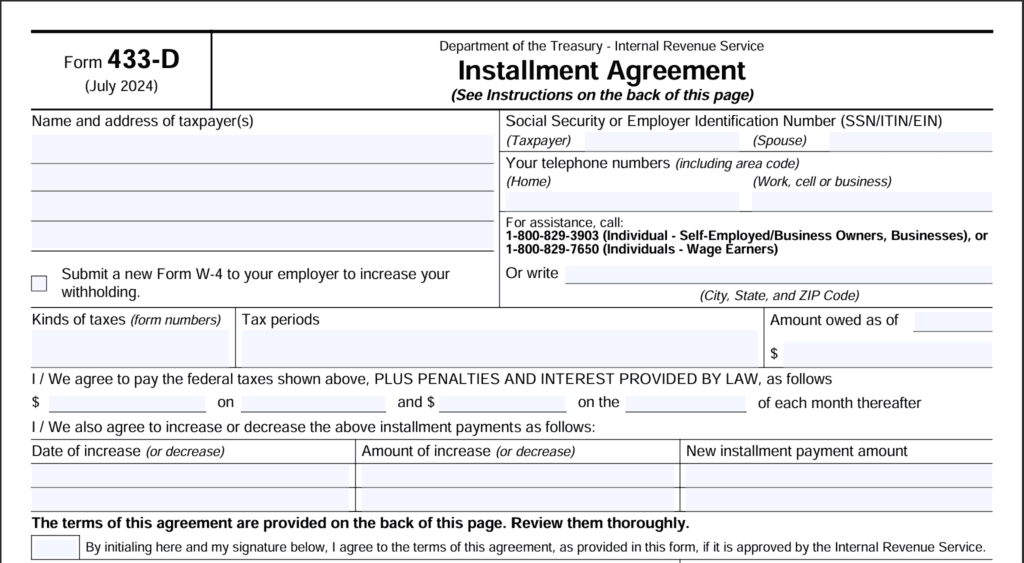

If you can’t pay your full tax bill right away, the IRS may let you set up a payment plan. Once the IRS approves your request for an installment agreement using Form 9465, IRS Form 433-D is used to officially set up the agreement so you can make monthly payments to reduce your tax debt.

What is the purpose of Form 433-D?

IRS Form 433-D allows you to make monthly payments toward your tax debt instead of paying everything at once. This can help you avoid more serious IRS actions, like taking money from your paycheck (wage garnishment) or putting a claim on your property (a lien).

When do you use Form 433-D?

You’ll use Form 433-D after the IRS agrees to your payment plan, especially if you choose to have the payments automatically taken from your bank account (called “direct debit”). This automatic payment method is usually required if you owe more than $25,000.

Please note: IRS Form 433 has multiple versions, each tailored to a specific financial situation. If you’re uncertain which form 433 to use, our detailed article can help clarify.

Who Should Use IRS Form 433-D?

Anyone who owes more in taxes than they can pay right away and needs to set up a monthly payment plan should use Form 433-D. This form is commonly used by people who need more time to pay their tax debt through smaller monthly payments.

How do you complete IRS Form 433-D?

To fill out Form 433-D, follow these steps:

- Personal Information – Write down your name, Social Security Number (SSN), and contact details.

- Bank Account Information – If you’re using automatic payments, provide your bank account number and routing number.

- Installment Payment Plan – Enter the amount you can afford to pay each month and the date you’ll make your first payment.

Required Supporting Documents

You don’t need to include any specific documents with Form 433-D. However, it’s a good idea to keep proof of your finances in case the IRS asks for it later. Also, keep a copy of the form and your payment schedule for your records.

How do you submit IRS Form 433-D?

You can mail Form 433-D to the IRS office handling your case, or you might be able to fax it. Once the IRS approves the plan, they’ll send you a confirmation in writing.

Final Thoughts

IRS Form 433-D is a useful option for taxpayers who need more time to pay their tax debts. By setting up a payment plan, you can avoid harsher IRS actions and work toward paying off your tax bill at a pace that fits your budget.

If you’re ready to finalize your installment agreement, you can download IRS Form 433-D to begin setting up your payment plan.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...