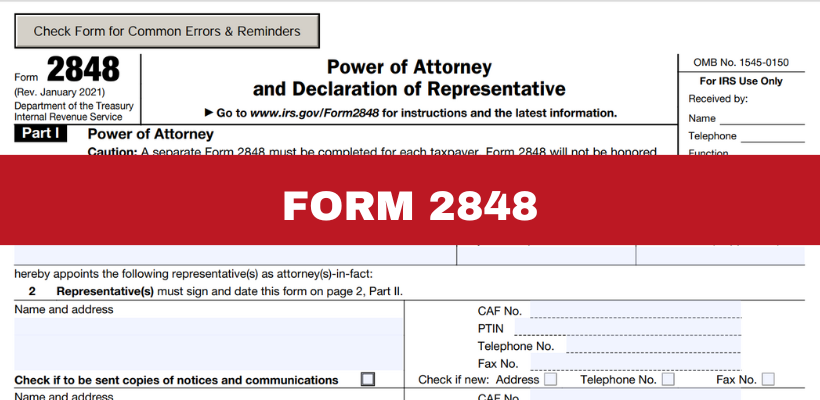

When it comes to navigating the complexities of taxes, sometimes you need a little help from someone you trust. This is where IRS Form 2848, also known as the Power of Attorney and Declaration of Representative, comes into play. This crucial form allows individuals to designate someone else to act on their behalf with the IRS, ensuring that important tax matters can be handled smoothly and efficiently.

What is IRS Form 2848?

IRS Form 2848 is a legal document that authorizes another person to represent you before the Internal Revenue Service (IRS).

By completing this form, you grant your representative the power to perform various tasks on your behalf, such as accessing your tax information, discussing your tax matters with the IRS, and signing agreements or documents related to your taxes. This is particularly useful in situations where you may not be able to handle your tax matters personally due to reasons such as illness, absence, or complexity of the issues involved.

Who Should File Form 2848?

You should consider filing Form 2848 if:

- You need representation. If you want someone to represent you before the IRS in tax matters, such as audits, appeals, or collection issues.

- You have complex tax issues. When dealing with complex tax issues that require professional assistance or legal expertise.

- You prefer convenience. If you prefer to have someone else handle your tax affairs due to personal or business reasons.

When to File Form 2848?

It’s important to file Form 2848 well in advance of when representation is needed. This allows sufficient time for the IRS to process the form and for your representative to familiarize themselves with your tax situation. Filing early ensures that your representative can act promptly when necessary, especially during critical times like audits or tax disputes.

How to File Form 2848?

Filing Form 2848 is a straightforward process:

- Complete the form.

Provide your personal information, the representative’s information, and specify the tax matters they are authorized to handle. - Authorization.

Both you (the taxpayer) and your representative must sign and date the form to authorize representation. - Submit to the IRS.

Send the completed form to the IRS office handling your tax matters. Make sure to use the correct mailing address based on your location and the type of tax issue.

Requirements When Filing Form 2848

When preparing Form 2848, make sure the following requirements are met:

- Accurate Information: Provide correct and complete details about yourself and your representative.

- Specific Authorization: Clearly specify the tax matters your representative is authorized to handle.

- Proper Signatures: Both you and your representative must sign and date the form.

- Updated Form: Use the most recent version of Form 2848 to avoid processing delays.

Final Thoughts

The IRS Form 2848 is a powerful tool that empowers taxpayers to designate a trusted representative to manage their tax affairs with the IRS. Whether you need help with complex tax issues or simply prefer having someone else handle your tax matters, this form ensures that you have the support you need. By understanding its purpose, knowing when and how to file it, and meeting all the requirements, you can effectively utilize Form 2848 to navigate the often intricate landscape of tax compliance and resolution.

At the Law Office of Steven N. Klitzner, we can act as your representative under a Power of Attorney to handle your IRS matters. Call us today at (305) 564-9199 or fill out our website contact form to schedule a free and confidential consultation.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...