When the IRS initiates collection actions like liens or levies, it can be a stressful experience. However, taxpayers have rights and options to challenge these actions. One powerful tool at their disposal is IRS Form 12153, Request for a Collection Due Process (CDP) or Equivalent Hearing. In this blog post, we’ll explore what this form is, why it’s important, and how to navigate the process to protect your rights and potentially avoid severe IRS collection measures.

What is Form 12153?

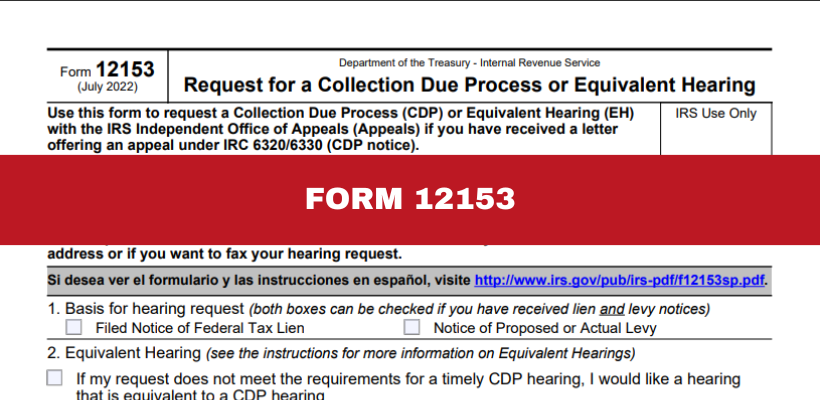

IRS Form 12153 is the official document taxpayers use to request a Collection Due Process (CDP) hearing or an equivalent hearing. This hearing allows you to dispute the IRS’s collection actions, such as liens or levies, before they become final. The hearing is conducted by the IRS Office of Appeals, an independent body that ensures a fair review of your case.

Why is filing Form 12153 important?

Filing Form 12153 is crucial for several reasons:

- Stop IRS collection actions. Once you file the form, most IRS collection actions, like wage garnishments or bank levies, are typically paused until the hearing is completed. This can provide temporary financial relief.

- Opportunity to present your case. The CDP hearing gives you the chance to present your side of the story. You can challenge the IRS’s actions, dispute the amount owed, or propose alternative solutions, such as an installment agreement or an offer in compromise.

- Protection of rights. By timely filing Form 12153, you preserve your right to appeal the IRS’s decisions in the U.S. Tax Court if you disagree with the outcome of the hearing.

When should you file Form 12153?

Timing is everything when it comes to filing Form 12153. You must file the form within 30 days of receiving the IRS’s notice of intent to levy or notice of a federal tax lien. Missing this deadline can limit your options, as you may only be eligible for an equivalent hearing, which does not offer the same level of protection and rights as a CDP hearing.

How to fill out Form 12153

Completing Form 12153 is relatively straightforward but requires attention to detail. Below is a breakdown of the sections:

Section 1: Taxpayer Information.

Provide your name, address, and Social Security Number (or Employer Identification Number for businesses).

Section 2: Type of Hearing Requested.

Indicate whether you’re requesting a CDP hearing or an equivalent hearing. The CDP hearing is more advantageous if you file within the 30-day deadline.

Section 3: Basis for Dispute.

This is a crucial section where you explain why you disagree with the IRS’s actions. You can challenge the underlying tax liability, propose alternative payment methods, or argue that the lien or levy would cause undue hardship.

Section 4: Tax Periods Involved.

Specify the tax periods for which you are disputing the IRS’s actions. Be as detailed as possible to ensure your request covers all relevant periods.

Section 5: Collection Alternatives.

Here, you can propose alternatives to the IRS’s collection actions, such as setting up an installment agreement or submitting an offer in compromise.

Supporting Documents

To strengthen your case, it’s wise to include supporting documentation with your Form 12153. This might include:

- Financial statements

- Proof of hardship

- Documentation of errors in the IRS’s calculations

These documents help the IRS Appeals Officer understand your situation and may increase the likelihood of a favorable outcome.

What happens after filing Form 12153?

After you submit Form 12153, the IRS will review your request and assign it to the Office of Appeals. You’ll be scheduled for a hearing where you can present your case. If you reach an agreement during the hearing, the IRS will cease its collection actions based on the terms you’ve agreed upon. If no agreement is reached, you may still have the right to take your case to the U.S. Tax Court.

Final Thoughts

Dealing with IRS collection actions can be daunting but Form 12153 offers an opportunity to challenge these actions and explore alternative resolutions. Filing this form in a timely and thorough manner can halt the IRS’s aggressive measures and give you the chance to negotiate a more manageable solution.

If you’ve received a notice from the IRS and are considering filing Form 12153, it’s often beneficial to consult with a tax professional that can guide you through the process, help you build a strong case, represent you at the CDP hearing and ensure your rights are fully protected. Call us today at (305) 564-9199 or fill out our website contact form to schedule a free and confidential consultation.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...