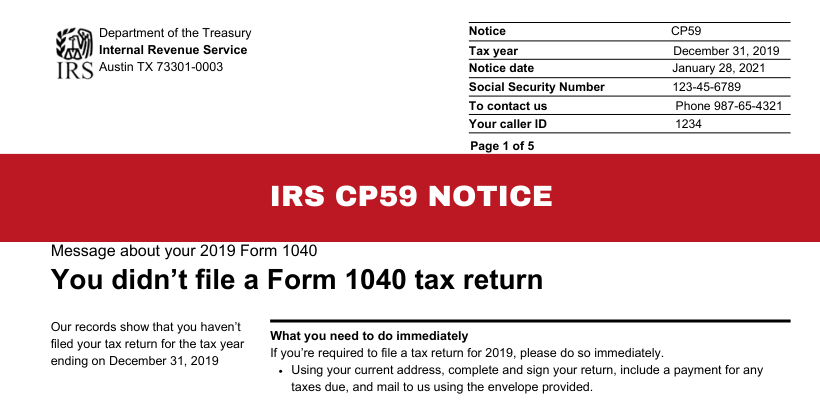

An IRS CP59 notice is an official letter sent by the IRS when they have no record of receiving your tax return for a specific year. This situation could arise if you missed filing your tax return entirely or if there was an unexpected delay in the processing of your return, which can sometimes occur due to clerical errors or backlogs within the IRS. It’s important to recognize that receiving this notice doesn’t necessarily mean you’ve failed to file; it could simply indicate that the IRS has not yet processed your return, or they didn’t receive it in the expected manner.

Understanding the implications of a CP59 notice and the necessary steps to resolve it is essential in order to avoid unwanted consequences, such as escalating penalties, accumulating interest on unpaid taxes, and the possibility of more severe IRS actions, like wage garnishment or liens. Taking prompt and informed action when you receive this notice is crucial in ensuring that your tax matters are handled efficiently and that you remain compliant with IRS regulations.

What is an IRS CP59 Notice?

The IRS issues a CP59 notice when they have no record of receiving your tax return for a particular year. Essentially, it’s a warning that your tax return is missing. In some cases, you may have already filed the return, but the IRS has not processed it yet. If that’s the case, it’s essential to verify your records to confirm that the return was filed on time.

If the IRS determines that your return has not been filed, they will give you an opportunity to file the missing return. If you fail to file by the specified deadline, the IRS may proceed with preparing a substitute return for you. A substitute return is usually less favorable, often resulting in higher taxes and potential penalties.

What happens after receiving a CP59 Notice?

Once you receive a CP59 notice, taking quick action is critical. The notice typically includes a deadline for filing the missing return. If you file by this deadline, the issue will likely be resolved without further complications. However, if the return remains unfiled, the IRS may assess taxes using a substitute return, which can result in a larger tax bill, along with additional penalties and interest.

To avoid these consequences, it’s important to respond promptly to the notice. Failing to do so could lead to further collection actions, such as wage garnishment or property liens.

What should you do when you receive a CP59 Notice?

Here’s what you need to do when you receive a CP59 notice:

- File the missing return. If you haven’t already filed your return, do so as soon as possible. Gather the necessary documents and file the return correctly. If you need assistance, consider consulting with a tax professional to ensure accuracy and completeness.

- Check for errors. If you believe you’ve already filed the return, double-check your records to confirm. Sometimes, the IRS may not have processed your return yet. If you find an error, contact the IRS to clarify the situation.

- Contact the IRS. If you need more time to file your return or have questions regarding the notice, contact the IRS using the contact information provided in the notice. Make sure to resolve the issue before the deadline to avoid further complications.

What are the consequences of not filing after receiving a CP59 Notice?

If you fail to file your return after receiving a CP59 notice, the IRS may prepare a substitute return for you. This substitute return often results in a higher tax liability because it doesn’t account for any deductions, credits, or exemptions you might be eligible for. As a result, you could owe significantly more in taxes than you would have if you had filed your own return.

Additionally, failure to file can lead to escalating penalties and interest on the unpaid tax, which can quickly add up.

Final Thoughts

The IRS CP59 notice serves as an important reminder to file any missing tax returns. If you receive one, it’s important to act promptly to file the necessary return or clarify the situation with the IRS. Ignoring the notice can lead to increased tax liabilities, penalties, and interest. The best course of action is always to take proactive steps to resolve the issue before it escalates.

If you need assistance navigating a CP59 notice or have questions about your tax filings, it is always a good idea to consult with a qualified tax professional. They can help you address the issue swiftly and ensure you remain in compliance with IRS regulations. If you have are currently dealing with a CP59 Notice and do not quite know what to do, reach out to us at the law office of Steven Klitzner for a free and confidential consultation.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...