When dealing with taxes, whether for personal financial planning, applying for loans, or resolving disputes, you may need to obtain a tax transcript from the IRS. This blog post will explain what a tax transcript is, the different types available, and how to request them using IRS Form 4506-T.

What is a Tax Transcript?

A tax transcript is a summary of your tax return information, provided by the IRS. It includes details specific to the type of transcript you request and is crucial for various financial and legal purposes. Despite its importance, the IRS takes security seriously and masks certain personal information to protect against identity theft.

Types of Tax Transcripts

There are different types of tax transcripts that display different kinds of information. Here are the main types of tax transcripts you can request:

- Tax Return Transcript: Shows most line items from your tax return as originally filed. This is useful for reviewing the details of your return.

- Tax Account Transcript: Provides information about your tax account, including adjustments or changes made after your return was filed. It helps in understanding account changes and resolving discrepancies.

- Wage and Income Transcript: Displays income information from forms like W-2s and 1099s. This is particularly helpful for verifying income when applying for loans or financial aid.

- Record of Account Transcript: Combines details from both the Tax Return and Tax Account Transcripts, offering a comprehensive view of your tax records.

- Verification of Non-Filing: Confirms that you did not file a tax return for a specific year. This can be important for verifying your tax status.

How can you request a tax transcript using Form 4506-T?

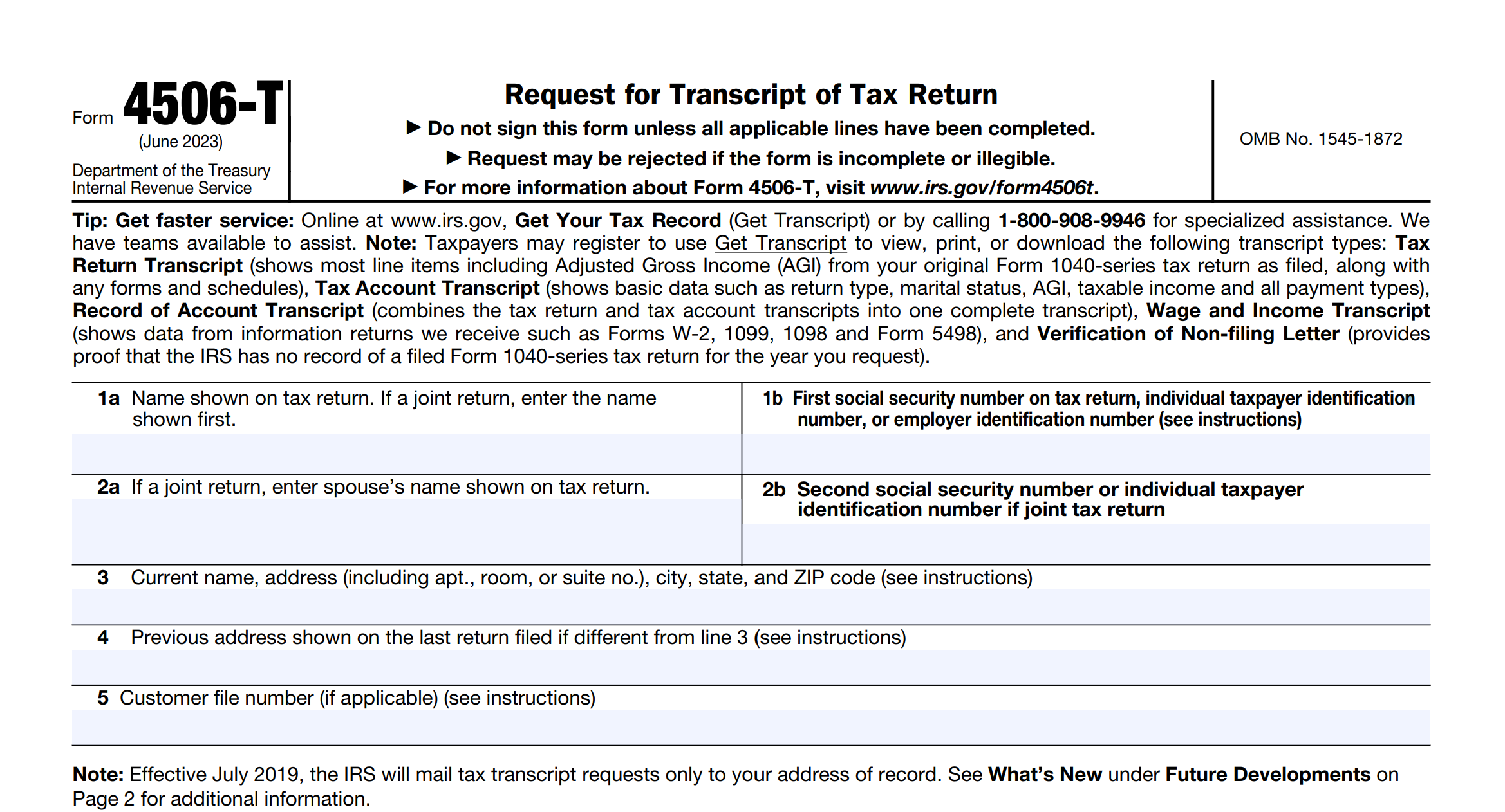

To obtain a tax transcript, you need to fill out IRS Form 4506-T, “Request for Transcript of Tax Return.” Here’s a step-by-step guide on how to complete the form:

Step 1: Download and complete Form 4506-T

- Access the form: You can download Form 4506-T from the IRS website.

- Fill in your information: Provide your name, address, and Social Security Number (SSN) or Employer Identification Number (EIN) in the relevant sections.

- Specify the Transcript Type: Check the box for the type of transcript you need (e.g., Tax Return Transcript, Wage and Income Transcript).

- Provide Details: Enter the tax year or period for which you are requesting the transcript.

Step 2: Include a Customer File Number (Optional)

- What is a Customer File Number? This is an optional 10-digit number that can be used to match the transcript to specific requests or records.

- How to Use It: If you have a Customer File Number, you can enter it in the designated field on the form. This number will appear on the transcript to assist in identification.

Step 3: Submit the form

- Submit the Form Online or by Mail: Depending on your preference, you can submit the form online through the IRS website or mail it to the appropriate address listed on the form.

- No Faxing: For security reasons, the IRS generally does not fax transcripts.

Security Measures

The IRS has implemented measures to protect your personal information:

- Masked Information: To prevent identity theft, sensitive details such as full SSNs are partially masked. However, financial data remains fully visible.

- Verification: The IRS will provide unmasked Wage and Income transcripts if required for tax preparation and filing.

Final Thoughts

Requesting a tax transcript using Form 4506-T is a straightforward process that can be helpful in managing your financial and legal affairs. Familiarize yourself with the different types of transcripts and follow the steps to request them so you can obtain the precise information you need. This not only helps with tax preparation, financial verification, and resolving disputes but also ensures that your personal data remains protected. With this guide, you can confidently navigate the process and secure the necessary documents while keeping your information safe.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...