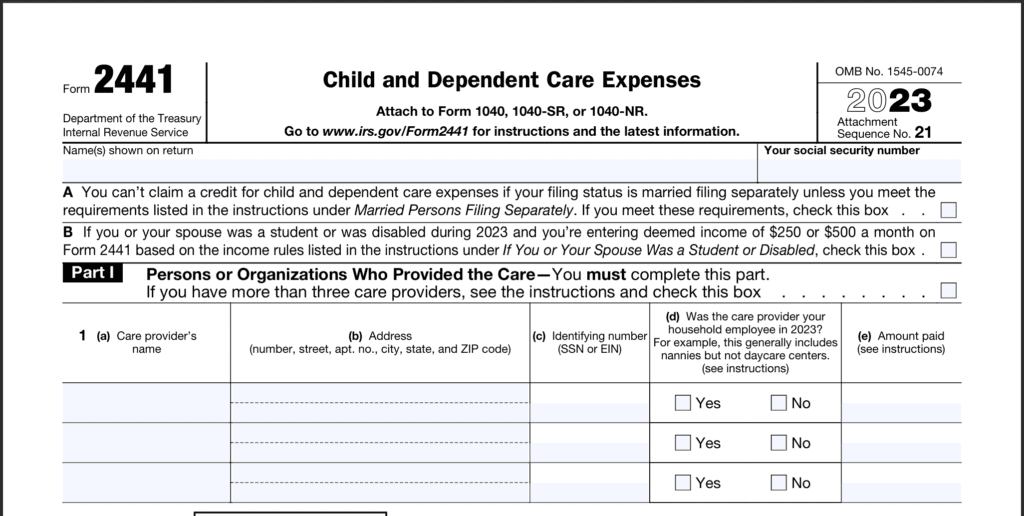

If you’ve paid for child or dependent care to enable you to work or search for a job, you might be missing out on a valuable tax benefit that can help lighten your financial load. IRS Form 2441, also known as the Child and Dependent Care Expenses form, is your chance to claiming the child and dependent care credit which is a tax break designed to assist working families. This credit not only helps offset the costs of childcare but can also significantly reduce your overall tax liability, putting more money back in your pocket.

What is IRS Form 2441?

IRS Form 2441 is essential for calculating the child and dependent care credit. This credit helps lower the amount of tax you owe by reimbursing a portion of the costs associated with caring for qualifying individuals. The credit applies not only to children under 13 but also to a spouse or a dependent who is physically or mentally unable to care for themselves.

Who should use IRS Form 2441?

If you incur care expenses for a child, spouse, or dependent to enable you to work or seek employment, you should use Form 2441 to claim the credit. This applies to both single and married taxpayers. However, if you’re married, you must file your taxes jointly to take advantage of this credit.

It’s important to note that the amount of the credit may vary based on your income and the number of qualifying dependents you have. For many families, this credit can lead to substantial tax savings.

How to fill out Form 2441

- Qualifying Person(s)

In this section, list the names, Social Security Numbers (SSNs), and qualifying care expenses for each child or dependent. Make sure the care expenses relate directly to the care provided during the tax year and verify that the individual qualifies for the credit. - Credit Calculation

Here, you’ll enter the total amount of care expenses you paid throughout the year. This includes payments made to the care provider for services. You will also need to provide information about the care provider, including their name, address, and taxpayer identification number (TIN). This information is crucial for the IRS to verify the expenses. - Dependent Care Benefits (if applicable)

If your employer offers a dependent care assistance program, you’ll need to report the amount of benefits received. This is important because it can affect the amount of care expenses eligible for the credit. Calculate the remaining expenses after accounting for these benefits to determine your credit.

What supporting documentation is needed?

While you don’t need to attach documentation with Form 2441 when you submit it, it’s vital to keep receipts, invoices, and records of payments made to your care providers. If the IRS decides to review your claim through an audit, having these documents on hand will help you provide evidence of your expenses and support your claim.

Where to file IRS Form 2441

IRS Form 2441 is submitted along with your federal income tax return, either electronically or by mail. If you file electronically, your tax software will typically guide you through the process of completing Form 2441. For those filing a paper return, make sure to include Form 2441 when submitting Form 1040 or 1040-SR.

Final Thoughts

Claiming the child and dependent care credit through IRS Form 2441 can significantly reduce your overall tax burden while ensuring that care expenses for your dependents are properly accounted for. It’s crucial to retain all necessary records to support your claim. If you find the process overwhelming or have specific questions, seeking help from a tax professional can provide peace of mind and ensure you’re maximizing your potential savings.

By knowing how to use Form 2441, you can take a proactive step towards managing your tax responsibilities and making the most of available tax credits.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...