Waiting for a tax refund is always an exercise in patience, but what happens if the check never arrives? If you suspect your refund check is lost, stolen, or was simply never sent, IRS Form 3911, Taxpayer Statement Regarding Refund, can help you track it down. Filing this form is the first step to either locating your refund or requesting a replacement check.

Why should you file IRS Form 3911?

If you’re expecting a refund but haven’t received it, Form 3911 allows you to officially inform the IRS about the issue and start the tracing process. By submitting this form, you’re asking the IRS to investigate what happened to your check—whether it’s lost, stolen, or misdirected. Filing Form 3911 can also help get the IRS to reissue a check if needed.

Who should use IRS Form 3911?

Form 3911 is specifically for taxpayers who haven’t received their expected refund and believe it may be lost or stolen. If your refund check was damaged or destroyed, you should also use this form. Additionally, if you filed jointly with a spouse and you’re missing your joint refund, Form 3911 is the appropriate way to request help from the IRS.

Completing IRS Form 3911

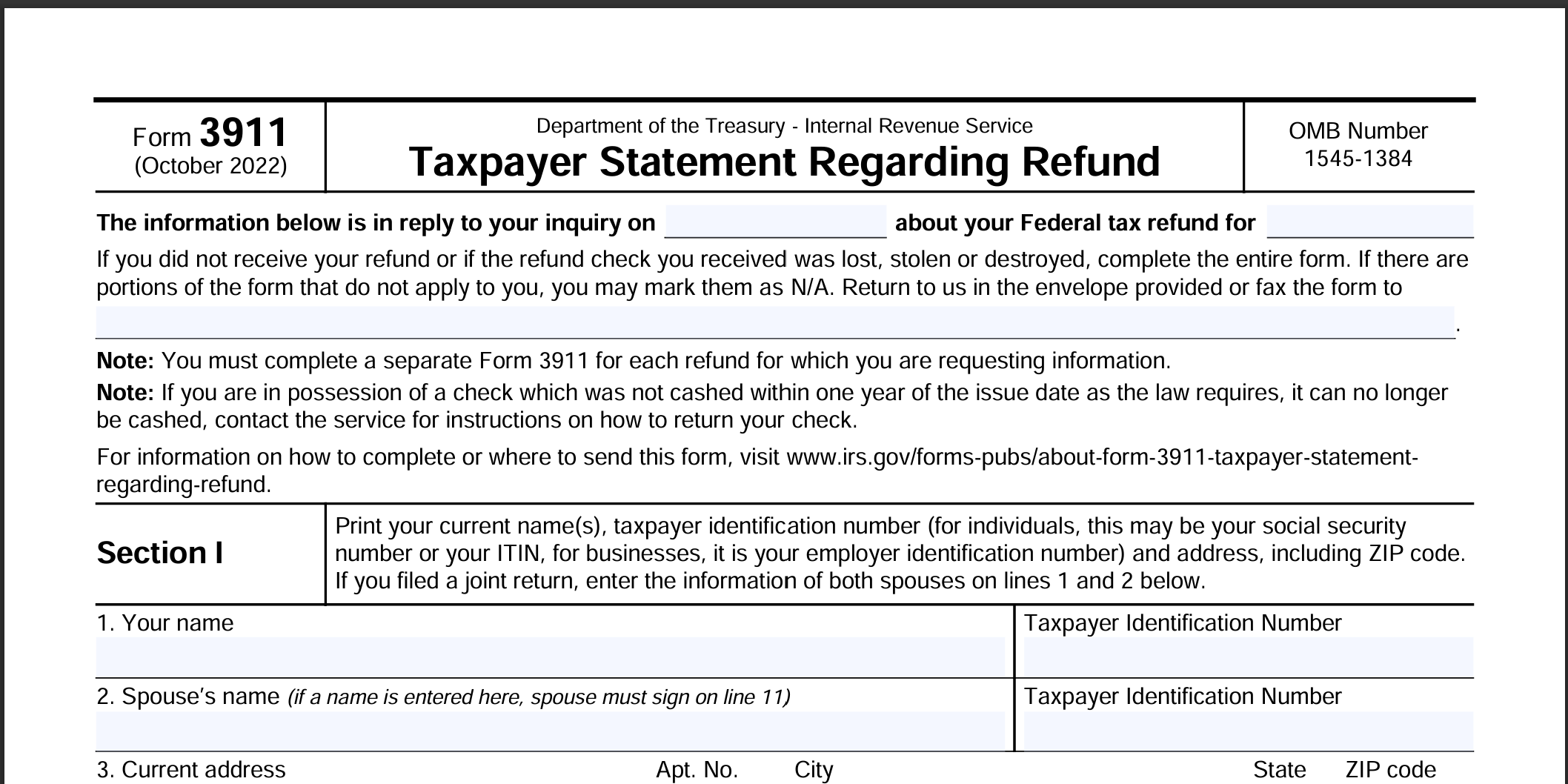

To complete Form 3911, you’ll need to provide basic information about yourself and your tax return:

- Personal Information: Write in your full name, Social Security Number (SSN), and address. If you filed jointly, include your spouse’s information as well.

- Refund Details: Note the exact amount of the refund you’re tracing.

- Payment Method: Indicate whether you originally requested a direct deposit or a paper check, as this helps the IRS trace the refund more accurately.

- Additional Information: Complete any other questions on the form that apply to your refund situation, such as details about your tax filing status or the year of the return in question.

Once you’ve filled out this information, you’ll be ready to send the form to the IRS.

What should you have handy before filing Form 3911?

You don’t need to attach any specific documents to Form 3911, but having your records on hand is a good idea. Keep a copy of your tax return, along with any IRS notices or correspondence related to your refund. This information isn’t required but could help speed up the process if the IRS needs more details.

How to submit IRS Form 3911 and start the refund trace?

Once you’ve completed Form 3911, you’ll need to either mail or fax it to the IRS office that handles returns for your state. Unfortunately, there isn’t an option to submit this form online yet, so you’ll have to stick to either mail or fax. You can find the correct mailing address and fax number for your location on the IRS website.

Final Thoughts

If your refund seems lost, IRS Form 3911 is your best option to get help from the IRS. Once the form is filed, the IRS will begin investigating the status of your refund. If they find it was lost or stolen, they’ll issue a new check.

In cases where the refund was sent but misdirected, they’ll provide instructions on how to retrieve it. Although waiting for a missing refund can be frustrating, using Form 3911 is the quickest way to resolve the situation and get your refund in hand.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...