When dealing with the IRS, it’s important to understand the forms that delegate authority to manage or represent a taxpayer’s interests. Two forms commonly used for this purpose are IRS Form 56 (Notice Concerning Fiduciary Relationship) and IRS Form 2848 (Power of Attorney and Declaration of Representative).

Though these forms share a few similarities, they serve distinct roles and are designed for different purposes. In this post, we’ll look at the key differences between these forms, clarifying the roles of a fiduciary versus an authorized representative.

Legal Authority

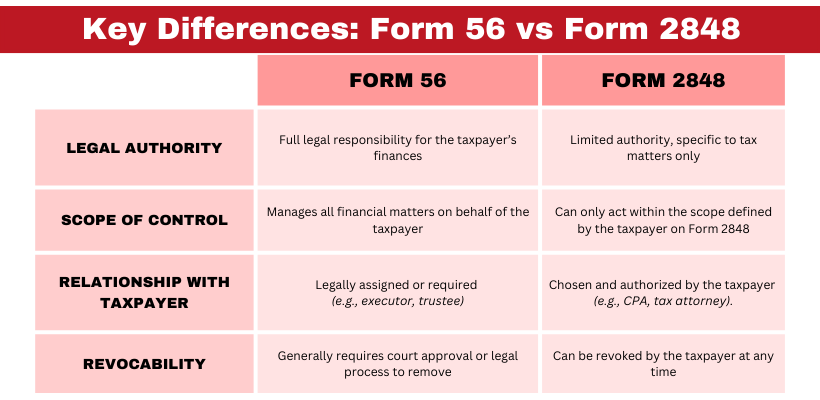

The first major difference between IRS Form 56 and Form 2848 lies in the extent of legal authority granted. Form 56 is designed to provide a fiduciary with broad legal authority over the taxpayer’s financial affairs. When this form is filed, the fiduciary assumes comprehensive responsibility for handling the taxpayer’s obligations, including tax filings, payments, and any correspondence related to the taxpayer’s financial matters.

This broad authority is necessary when the taxpayer is unable to manage their own finances due to legal restrictions, such as in cases where a court-appointed executor manages an estate or a trustee oversees a trust. In this role, the fiduciary has a duty to act in the taxpayer’s best interests, ensuring that all financial matters are handled responsibly and in compliance with the law.

By contrast, IRS Form 2848 grants only limited authority and is specific to tax-related matters. This form gives an authorized representative, such as a tax professional or attorney, permission to act on behalf of the taxpayer in specific dealings with the IRS.

Unlike a fiduciary, the authorized representative is limited to the scope defined on Form 2848 and only has authority in the specific tax issues listed by the taxpayer, such as during an audit or appeal process. This means that Form 2848 does not grant full control over the taxpayer’s finances but instead confines the representative’s authority to IRS matters alone.

Scope of Control

The scope of control provided by each form is another key difference between Form 56 and Form 2848. When Form 56 is filed, the fiduciary gains comprehensive control over the taxpayer’s financial matters, extending beyond just IRS issues. This form enables the fiduciary to handle all financial responsibilities that the taxpayer would otherwise manage.

For instance, an executor of an estate might be responsible for not only managing IRS communications but also paying outstanding debts, distributing assets, and ensuring that the estate’s affairs are fully settled. With this comprehensive authority, the fiduciary essentially steps into the taxpayer’s shoes for financial matters, handling everything that the taxpayer would normally be responsible for.

In comparison, the scope of control under Form 2848 is much more limited and specifically confined to IRS-related issues. An authorized representative under Form 2848 is only granted authority for specific tax matters as outlined by the taxpayer on the form.

For example, the taxpayer might appoint a representative to handle an audit, negotiate a payment plan, or resolve specific disputes with the IRS. However, the representative’s authority is restricted to only those designated tax matters, meaning they do not have control over the taxpayer’s broader financial affairs. This limited scope allows taxpayers to receive professional help for IRS issues without relinquishing full control over all of their financial matters.

Relationship with the Taxpayer

The relationship established by each form differs based on the origin and nature of authority granted. IRS Form 56 creates a fiduciary relationship, one that is rooted in a legal duty or requirement.

Fiduciaries, such as executors, trustees, or guardians, are often appointed due to legal mandates or court orders and are obligated to act in the best interest of the taxpayer. These roles are typically assigned when the taxpayer is unable to manage their finances independently, such as in cases of death or incapacity. The fiduciary relationship is thus based on a legal obligation and carries a high degree of responsibility and trust.

On the other hand, IRS Form 2848 establishes a voluntary relationship between the taxpayer and their authorized representative. The taxpayer chooses this representative specifically for handling certain tax matters, often selecting a tax professional like a CPA, attorney, or enrolled agent to provide expertise and support in dealing with the IRS.

Unlike the fiduciary relationship, which is legally appointed, the relationship with an authorized representative is entirely voluntary, allowing the taxpayer to decide who will represent them and in what capacity.

Revocability

Finally, the process of revoking the authority granted by each form differs significantly. With IRS Form 56, the fiduciary’s authority is typically difficult to revoke and often requires formal legal steps, especially when the fiduciary role is assigned by a court.

For example, if an executor or trustee needs to be removed from their position, a court order may be necessary to relieve them of their responsibilities. Because fiduciaries hold legal responsibilities that extend beyond IRS interactions, the process of revoking their authority is more complex and must follow legal guidelines.

In contrast, revoking IRS Form 2848 is a straightforward process that can be initiated by the taxpayer at any time. The taxpayer can submit a written request to the IRS to terminate the authority of their authorized representative or file a new Form 2848 to update or limit the representative’s authority. Since the authorized representative is chosen voluntarily, the taxpayer has more flexibility in managing this relationship and can make changes as needed without requiring legal intervention.

Final Thoughts

Deciding between IRS Form 56 and Form 2848 comes down to understanding the role you’re stepping into. If you’re taking on full financial responsibility, Form 56 gives you that broader legal authority as a fiduciary. But if the focus is only on handling specific tax matters, Form 2848 lets you work with the IRS without taking over all financial decisions.

Each form has its own purpose, and choosing the right one can make a big difference in keeping things clear and hassle-free. If you’re still uncertain, talking to a tax professional can help ensure you’re on the right path. Making the right choice upfront not only streamlines your IRS interactions but also ensures the taxpayer’s interests are well-protected.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...