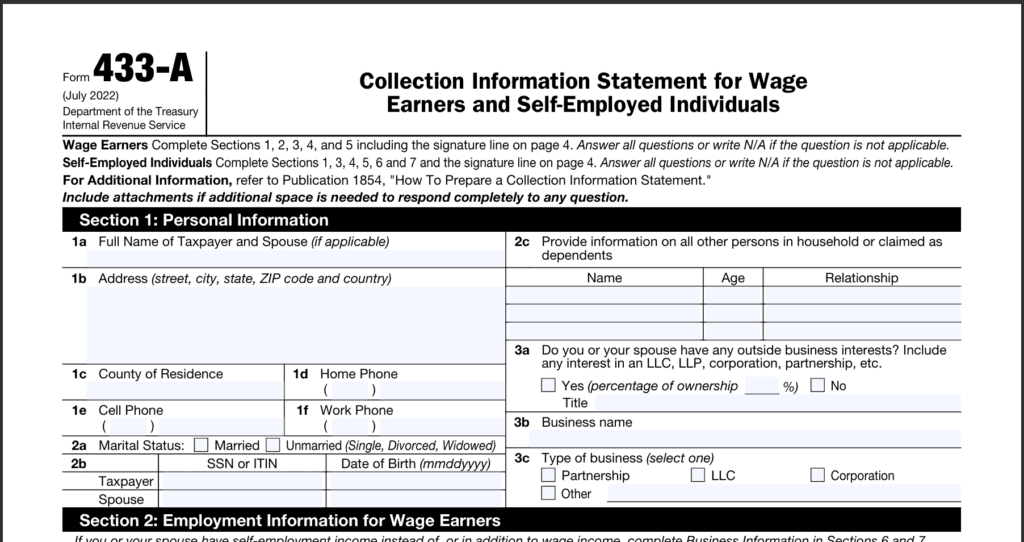

When dealing with tax debt, the IRS requires certain information to understand your financial situation fully. IRS Form 433-A is a detailed form that allows taxpayers to give the IRS an overview of their income, expenses, assets, and debts. By filling out this form, you provide the IRS with the information it needs to decide on a payment plan, an Offer in Compromise (where the IRS agrees to settle for less than the total owed), or even a temporary delay in collections if you can’t pay right now.

What is the purpose of IRS Form 433-A?

IRS Form 433-A is a collection information statement designed to help taxpayers show the IRS exactly where they stand financially. This form covers everything from your monthly income to the value of assets like property and vehicles. The IRS uses this information to assess your ability to pay your tax debt and to determine what type of resolution makes sense based on your finances.

Without this detailed information, the IRS can’t effectively evaluate your case, which means they might opt for more aggressive collection actions, like placing a lien on your property or garnishing your wages. Filling out Form 433-A allows you to share your circumstances and helps you avoid these more severe consequences.

Who Needs to File IRS Form 433-A?

Form 433-A is required for individuals who owe taxes and are seeking one of several specific types of relief:

- Offer in Compromise – This is an agreement with the IRS to settle your debt for less than the total owed. The IRS only accepts these offers when they believe the amount is the most they can expect to collect.

- Payment Plan (Installment Agreement) – If you can’t pay your tax debt in full immediately, you may request to pay it over time in monthly installments. The IRS uses Form 433-A to decide on the terms of your payment plan.

- Currently Not Collectible Status – If you’re experiencing serious financial hardship, the IRS may temporarily delay collection actions. Form 433-A helps determine if you qualify for this status.

This form is most often used by wage earners, self-employed individuals, and sole proprietors, who rely on their personal income to manage their finances.

How to complete IRS Form 433-A

To fill out Form 433-A, you’ll need to gather all relevant financial details to complete each section accurately. Here’s a breakdown of the sections:

- Personal and Employment Information – Begin by entering your name, Social Security Number (SSN), contact details, and employment information. If you’re self-employed, include your business details.

- Income and Expenses – This section requires you to report all sources of income, such as wages, self-employment income, and any other earnings. You’ll also need to detail your monthly living expenses, including:

- Housing (rent or mortgage payments)

- Utilities (electricity, water, gas)

- Transportation (car payments, gas, insurance)

- Other regular expenses, like food and medical costs

By listing all your monthly income and expenses, the IRS can determine if you can afford to make payments and, if so, how much.

- Assets and Liabilities – This part of the form is where you list what you own (assets) and what you owe (liabilities):

- Assets include things like real estate, vehicles, savings, and any other valuable property. You’ll need to estimate the current value of these items.

- Liabilities cover debts like loans, credit card balances, and any other financial obligations.

Providing this information gives the IRS a clear view of your overall financial health.

What documents should you submit with IRS Form 433-A?

To support the information you provide, the IRS generally requires that you include specific documents along with Form 433-A. These help confirm your income, expenses, and debts:

- Pay stubs – Recent pay stubs show proof of income if you’re employed.

- Bank statements – These confirm your cash assets and help the IRS assess your financial activity.

- Mortgage or rent statements – If you have a mortgage or pay rent, these statements provide details of your housing costs.

- Utility bills – Bills for electricity, water, and other utilities prove your monthly living expenses.

Including these documents when you file the form will help avoid delays in processing.

How to submit IRS Form 433-A

Once you have completed Form 433-A and gathered the necessary documents, you should mail it to the IRS office that handles your case. Ensure you check which IRS office to send it to, as it can vary based on your location and the type of tax debt involved. Submitting everything correctly and promptly is essential, as missing information can slow down the process, potentially leading to more severe collection actions by the IRS.

Final Thoughts

Form 433-A is an important step for taxpayers negotiating with the IRS about unpaid taxes. Providing a thorough overview of your financial situation helps the IRS understand your ability to pay and can lead to options that suit your budget, from monthly payments to potentially reducing the total amount owed. Completing Form 433-A accurately can be the key to a manageable path toward resolving your tax debt and reducing financial stress.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...