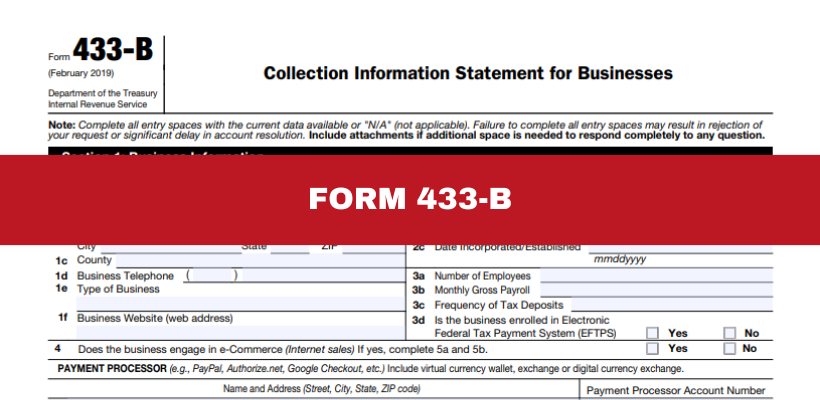

If your business is grappling with tax debt, you might find yourself required to submit IRS Form 433-B, also known as the Collection Information Statement for Businesses. This form is critical in providing the IRS with a detailed picture of your business’s financial situation. Understanding how to complete Form 433-B accurately can be the difference between a manageable resolution and more severe collection actions.

What is IRS Form 433-B?

IRS Form 433-B is a comprehensive financial disclosure form that businesses must complete when they owe back taxes and are seeking relief through an installment agreement, offer in compromise (OIC), or other collection alternatives. The IRS uses the information provided on this form to evaluate your business’s ability to pay its tax debts over time.

Heads up: IRS Form 433 comes in different types, and each one serves a different role. Not sure which one you need? Click here to learn more.

When should you use Form 433-B?

You may be required to complete Form 433-B if your business:

- Owes back taxes

When your business cannot pay its tax debt in full and needs to negotiate a payment plan or settlement. - Is Facing IRS Collection Actions

If the IRS is threatening levies or asset seizures, providing a Form 433-B can help demonstrate your financial situation and potentially prevent such actions. - Is Experiencing Financial Hardship

If your business cannot afford to pay its taxes due to financial difficulties, the form can be used to request more favorable terms.

Important Parts of Form 433-B

- Business Information. This section captures basic details about your business, including its legal name, Employer Identification Number (EIN), and contact information. It’s important to ensure this information is accurate, as it establishes the identity of the business in the IRS’s records.

- Business Assets. Here, you’ll need to list all assets owned by the business, such as bank accounts, real estate, vehicles, and machinery. The IRS will assess these assets to determine if any could be liquidated to pay down your tax debt. Be thorough in this section, as underreporting assets can lead to complications.

- Business Liabilities. In this section, you’ll report all liabilities, including loans, credit card debts, and mortgages. Accurately listing liabilities helps the IRS understand the financial obligations that your business must meet, which is crucial for assessing your ability to pay your tax debt.

- Business Income and Expenses. This section requires a detailed breakdown of your business’s monthly income and expenses. This includes all revenue streams and recurring expenses like rent, payroll, utilities, and supplies. The IRS uses this information to calculate your business’s cash flow, which is a key factor in determining what kind of payment plan, if any, the IRS might offer.

- Supporting Documentation. Along with Form 433-B, you’ll need to submit supporting documents that verify the information provided. This can include bank statements, contracts, income proof, and receipts for expenses. These documents are important in backing up the claims made in your form.

Why should you fill out Form 433-B accurately?

Filling out Form 433-B accurately is vital. Incomplete or incorrect information can lead to delays, denials of payment plans, or worse, enforcement actions like bank levies or asset seizures. Given the complexities of this form, it may be beneficial to get professional help from a tax attorney or enrolled agent to ensure that your submission is both accurate and complete.

Final Thoughts

IRS Form 433-B plays a critical role in resolving tax issues for businesses. By providing the IRS with a clear picture of your financial situation, this form can open the door to manageable payment arrangements or settlements. However, the stakes are high and errors on this form can lead to further complications with the IRS. If your business is facing tax challenges, consider seeking professional assistance to navigate the complexities of Form 433-B and protect your financial future.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...