When it comes to payroll taxes, the IRS takes noncompliance very seriously. Employers are required to withhold certain taxes—known as “trust fund taxes“—from their employees’ wages and remit them to the government. Failing to do so can result in severe penalties, including the Trust Fund Recovery Penalty (TFRP).

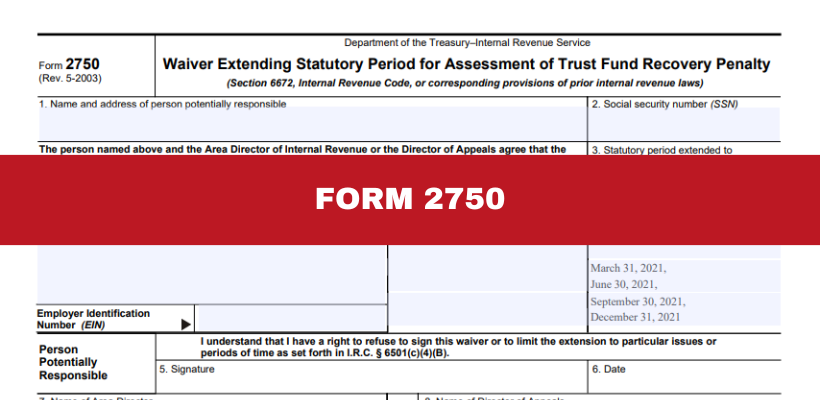

But what happens if the IRS needs more time to investigate and assess this penalty? That’s where IRS Form 2750, also known as the Waiver Extending Statutory Period for Assessment of Trust Fund Recovery Penalty, comes into play.

What is IRS Form 2750?

IRS Form 2750 is a legal document that extends the time the IRS has to assess the Trust Fund Recovery Penalty against individuals responsible for ensuring that payroll taxes are properly collected and paid to the IRS. The Trust Fund Recovery Penalty is significant because it can be assessed against individuals personally, not just against the business entity.

When is Form 2750 used?

The IRS typically has a three-year period from the tax return due date or the date the tax is assessed to impose the TFRP. However, in cases where the IRS requires more time to gather evidence or conduct its investigation, the responsible party might be asked to sign Form 2750, voluntarily agreeing to extend the statutory period for assessment.

Should you sign Form 2750?

Agreeing to sign Form 2750 is voluntary, and it’s not a decision to be taken lightly. Extending the assessment period could give you more time to negotiate or provide additional information that might reduce your liability. However, it also means the IRS will have more time to build its case against you. Before agreeing to an extension, it’s advisable to consult with a tax professional who can help you understand the potential risks and benefits.

Why It Matters

The TFRP can have serious financial consequences for individuals found responsible for unpaid trust fund taxes. If you’re in a position where Form 2750 has been presented to you, understanding what it means and the implications of signing it is crucial. Extending the assessment period might provide some breathing room, but it also opens the door for further scrutiny by the IRS.

Final Thoughts

IRS Form 2750 plays a critical role in cases involving unpaid payroll taxes and the Trust Fund Recovery Penalty. If you’re asked to sign this waiver, be sure to seek professional advice to ensure you’re making the best decision for your situation. At the law office of Steven N. Klitzner, we can help you deal with issues such as the Trust Fund Recovery Penalty. Schedule a free and confidential consultation today by filling out our website contact form or call us at (305) 564-9199.

Remember, while extending the assessment period may seem like a good idea, it could also prolong your exposure to significant penalties.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...