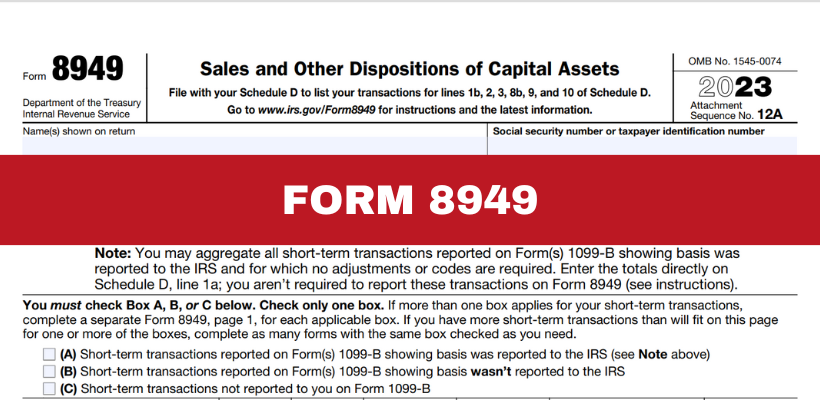

Tax season often brings a flurry of forms and documents, each serving a specific purpose in the complex landscape of tax filing. One such form, often a point of confusion for many taxpayers, is IRS Form 8949, used for reporting sales and other dispositions of capital assets. Knowing your away around this form is crucial for individuals and businesses alike to accurately report their capital gains and losses to the Internal Revenue Service (IRS).

What is IRS Form 8949?

IRS Form 8949 serves as a detailed breakdown of all individual capital asset transactions that have taken place during the tax year. It is used to report both short-term and long-term capital gains and losses. This form is essential for taxpayers who have sold stocks, bonds, mutual funds, real estate, or any other type of capital asset during the year.

Who should file Form 8949?

Anyone who has sold capital assets during the tax year must file Form 8949 along with their tax return. This requirement applies to individual taxpayers, as well as businesses, trusts, and estates that have realized capital gains or losses.

When should Form 8949 be filed?

Form 8949 must typically be filed along with Schedule D (Capital Gains and Losses) and attached to either Form 1040 (individual income tax return) or Form 1065 (partnership tax return), depending on the taxpayer’s filing status.

The due date for filing Form 8949 coincides with the due date of the tax return, usually April 15th for individuals (or the next business day if it falls on a weekend or holiday).

How can Form 8949 be filed?

Form 8949 can be filed electronically or by mail, depending on how the taxpayer chooses to submit their tax return. Most taxpayers file electronically, which is generally faster and allows for quicker processing by the IRS. Tax preparation software often includes Form 8949 as part of its package, making it easier for taxpayers to input their capital gains and losses directly.

Requirements When Filing Form 8949

When completing Form 8949, taxpayers must ensure the accuracy and completeness of the information provided. Each transaction involving a capital asset sale must be reported separately, with details such as the date of sale, the proceeds received, the cost basis, and the resulting gain or loss. It’s crucial to correctly categorize transactions as either short-term or long-term, as this affects the tax rate applied.

In addition to that, taxpayers must be prepared to provide supporting documentation for each transaction reported on Form 8949. This includes records such as brokerage statements, purchase and sale confirmations, and any other relevant documents that verify the details of each transaction.

Final Thoughts

Understanding IRS Form 8949 may seem complicated at first, but it’s essential for accurately reporting your taxes. This form helps you document and report sales of investments and other assets to the IRS.

By filling out Form 8949 correctly, you ensure that you follow IRS rules and manage your taxes effectively. Using tax software or getting help from a tax professional can make this process easier and reduce mistakes.

As tax laws change over time, staying informed and taking proactive steps to meet your tax obligations remain important. Form 8949 is a tool that helps you handle your taxes, and being familiar with its purpose and requirements allows you to navigate your financial responsibilities with confidence.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...