From our previous blog post, we learned that it is indeed possible for the IRS to garnish Social Security benefits through the Federal Payment Levy Program (FPLP). This program allows the IRS to levy, or seize, a portion of certain Social Security benefits to satisfy unpaid tax debts.

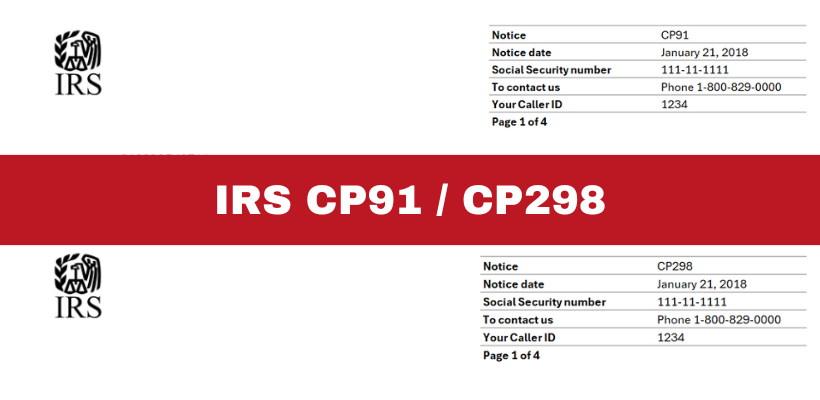

If you owe taxes and the IRS decides to use this collection method, you will receive a final notice of intent to levy, along with your appeal rights, and an additional notice labeled CP91 or CP298. These notices are not just formalities— they are critical alerts that demand your immediate attention and action.

Understanding what these notices mean and the steps you need to take can help you avoid significant financial hardship. The CP91 or CP298 notice indicates that the IRS is ready to proceed with levying your benefits unless you take prompt action to address your tax debt. Knowing your rights and options can make a significant difference in how you manage this situation and protect your financial well-being.

What is a CP91 or CP298 notice?

The IRS issues CP91 or CP298 notice, also known as the Final Notice Before Levy on Social Security Benefits, to inform taxpayers that their Social Security benefits will be included in the Federal Payment Levy Program (FPLP). This notice serves as a final warning before the IRS begins to levy, or seize, a portion of your Social Security benefits to satisfy unpaid tax debt.

What should you do when you receive a CP91 or CP298 Notice?

Receiving a CP91 or CP298 notice is serious, and it indicates that the IRS intends to take collection action unless you make arrangements to settle your tax debt. It also ensures you are aware of your rights to appeal the decision or to make payment arrangements. Ignoring this notice can result in the IRS levying up to 15% of your monthly Social Security benefits.

Here’s what you need to know and the steps you should take if you receive a CP91 or CP298 notice:

- Understand your rights. You have the right to appeal the IRS’s decision to levy your Social Security benefits. The notice will provide information on how to request a Collection Due Process (CDP) hearing.

- Take immediate action. Contact the IRS immediately upon receiving this notice. You can discuss payment options or present any reasons why the levy shouldn’t proceed.

- Make payment arrangements. If you cannot pay the full amount owed, explore alternative payment arrangements such as an installment agreement or an offer in compromise.

- Seek professional help. If you are unsure how to proceed or need assistance negotiating with the IRS, consider seeking help from a tax professional. At the law office of Steven N. Klitzner, we specialize in assisting individuals with tax-related issues and managing interactions with the IRS. You can call us today at (305) 564-9199 or fill out our website contact form to schedule a free and confidential consultation.

Receiving a CP91 or CP298 notice from the IRS is a critical situation that requires swift action. Understanding the implications and promptly addressing your tax debt can help you avoid significant financial consequences. Take advantage of the resources and options available to resolve the issue effectively and protect your financial well-being.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...