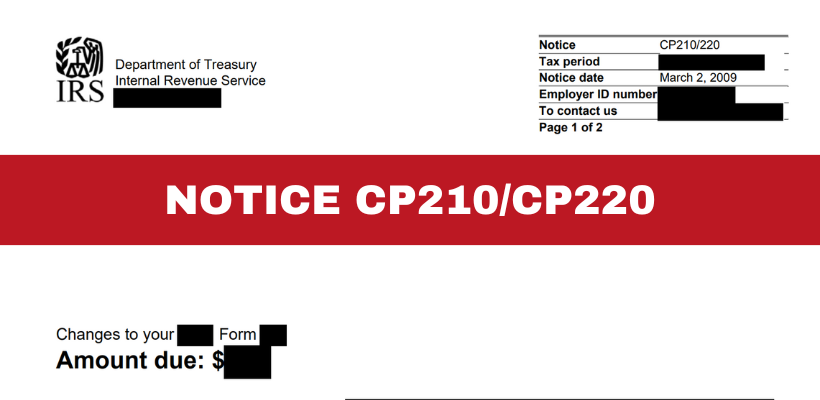

When the IRS identifies discrepancies or adjustments needed for a specific tax year, they notify taxpayers through Notice CP210 or CP220. These notices are typically sent to businesses, informing them that changes have been made to their tax return.

What is the IRS Notice CP210/CP220 about?

IRS Notices CP210 and CP220 serve to notify you that the IRS has made adjustments to your tax return. While these notices are often used interchangeably, they both indicate that the IRS has identified issues or discrepancies in your filed return and has adjusted it accordingly. The specifics of what the IRS disagrees with and how your return has been adjusted will be detailed in the notice.

Who Receives This Notice?

These notices are primarily sent to businesses rather than individuals. If your business has discrepancies or adjustments in its tax return for a specific year, you will likely receive one of these notices.

Key Information Contained in the Notice

A Notice CP210 or CP220 will typically include the following information:

- The tax year for which adjustments were made.

- Details of the adjustments and the reasons behind them.

- Any additional tax owed or refund due as a result of these adjustments.

- Instructions on what steps to take next.

Common Reasons for Receiving This Notice

There are several reasons why your business might receive a Notice CP210 or CP220, including:

- Errors in your original tax return.

- Omissions or discrepancies in reported income or deductions.

- Changes resulting from an IRS audit or review.

What to Do When You Receive This Notice

Receiving an IRS notice can be concerning, but it’s important to address it promptly. Here are the steps you should take:

- Review the notice carefully.

Understand the adjustments made and the reasons provided by the IRS. - Contact the IRS.

If you have questions or need further clarification, call the IRS at the number provided in the notice. Be prepared with your tax information and specific details from the notice. - Respond within the prescribed period.

The notice will specify a timeframe within which you must respond. Make sure that you take action within this period to avoid penalties or further issues. - Seek professional help.

If the adjustments are complex or you disagree with them, consider consulting a tax professional for assistance in resolving the matter.

If you need expert advice, you can contact us at (305) 564-9199 or use our website contact form for a free and confidential consultation. At the law office of Steven N. Klitzner, we specialize in tax matters and can provide expert advice to help you navigate the complexities of IRS notices and adjustments. Don’t hesitate to reach out for a free consultation to ensure your business remains compliant and to address any concerns you may have.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...