If you could have someone handle your IRS issues for you, would you? Let’s face it —having to deal with the IRS to talk about issues such as back taxes, installment agreements, liens, levies, and all the other legal terms that make you want to run and hide—a substitute, or in this case, a representative, seems like a great relief. This is the authority granted by an IRS Power of Attorney.

With a Power of Attorney, you can appoint someone else to deal with the IRS on your behalf. That is, all correspondence from the IRS, be it calls or mail, will be addressed to your representative and not to you. And this way, you can be spared of the stress that comes with dealing with the IRS.

Before you authorize someone to represent you before the IRS, you will need to understand what a Power of Attorney is and the scope of its authority.

Understanding the IRS Power of Attorney

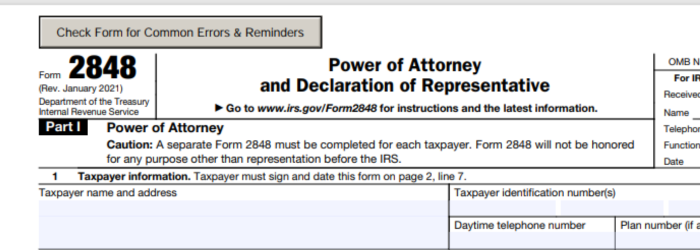

The IRS Power of Attorney, often referred to as Form 2848, is a powerful legal document that allows an individual or entity to authorize a representative, such as a tax attorney, to act on their behalf before the Internal Revenue Service. This authorization empowers the designated representative to handle a wide range of tax-related tasks and interactions with the IRS, ensuring that our clients’ interests are protected and advocated for effectively.

What is the scope of authority of an IRS Power of Attorney?

The scope of authority granted through the IRS Power of Attorney is a critical aspect to consider. Basically, it defines the extent to which our representation can benefit our clients.

Here’s how it works:

- Comprehensive Representation

With a broad grant of authority, we can represent you in all tax matters before the IRS. This includes responding to inquiries, providing information, signing agreements, negotiating settlements, and advocating for your interests at every step of the process. - Tailored Solutions

We can also customize the scope of authority based on your specific needs. Whether you require representation for a particular tax issue, tax year, or type of tax, we can tailor our services to suit your unique circumstances. - Focused Action

If you have specific tasks or actions in mind, we can be authorized to perform those on your behalf. From accessing tax transcripts to requesting extensions or signing certain documents, we’re here to streamline the process and alleviate the burden on your shoulders.

Here’s how we can help you with your IRS concerns…

By granting us the authority through the IRS Power of Attorney, you’re entrusting us with the responsibility to safeguard your interests and deal with the complexities of tax matters on your behalf.

Our team of experienced tax professionals possesses the expertise and dedication needed to ensure that your rights are protected and that you receive the best possible outcome in your dealings with the IRS.

At the law office of Steven N. Klitzner, we’re committed to providing personalized and results-driven representation tailored to meet your unique needs and objectives. With our in-depth understanding of tax laws and regulations, as well as our unwavering advocacy on your behalf, you can trust us to be your trusted ally in facing any tax-related challenges.

Take the next step…

If you’re facing tax issues or uncertainties and are seeking reliable representation before the IRS, don’t hesitate to reach out to us. Schedule a consultation with our team today and let us help you deal with the complexities of tax matters with confidence and peace of mind. Together, we’ll work towards achieving the best possible resolution for your tax-related concerns.

Call us at (305) 564-9199 for a free, confidential consultation and empower yourself with expert representation.

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...

Steven N. Klitzner, P.A. is a tax attorney based in Miami, Florida. He has been practicing tax law for over 40 years, and currently holds a 10.0 rating by Avvo. Mr. Klitzner was appointed to the IRS Service Advisory Council in 2021 and is...